Looking for clear and concise—yet sophisticated—editing? Need to comply with plain language requirements?

WordRake can help your organization succeed!

- Confidential

- Secure

- Reliable

- Affordable

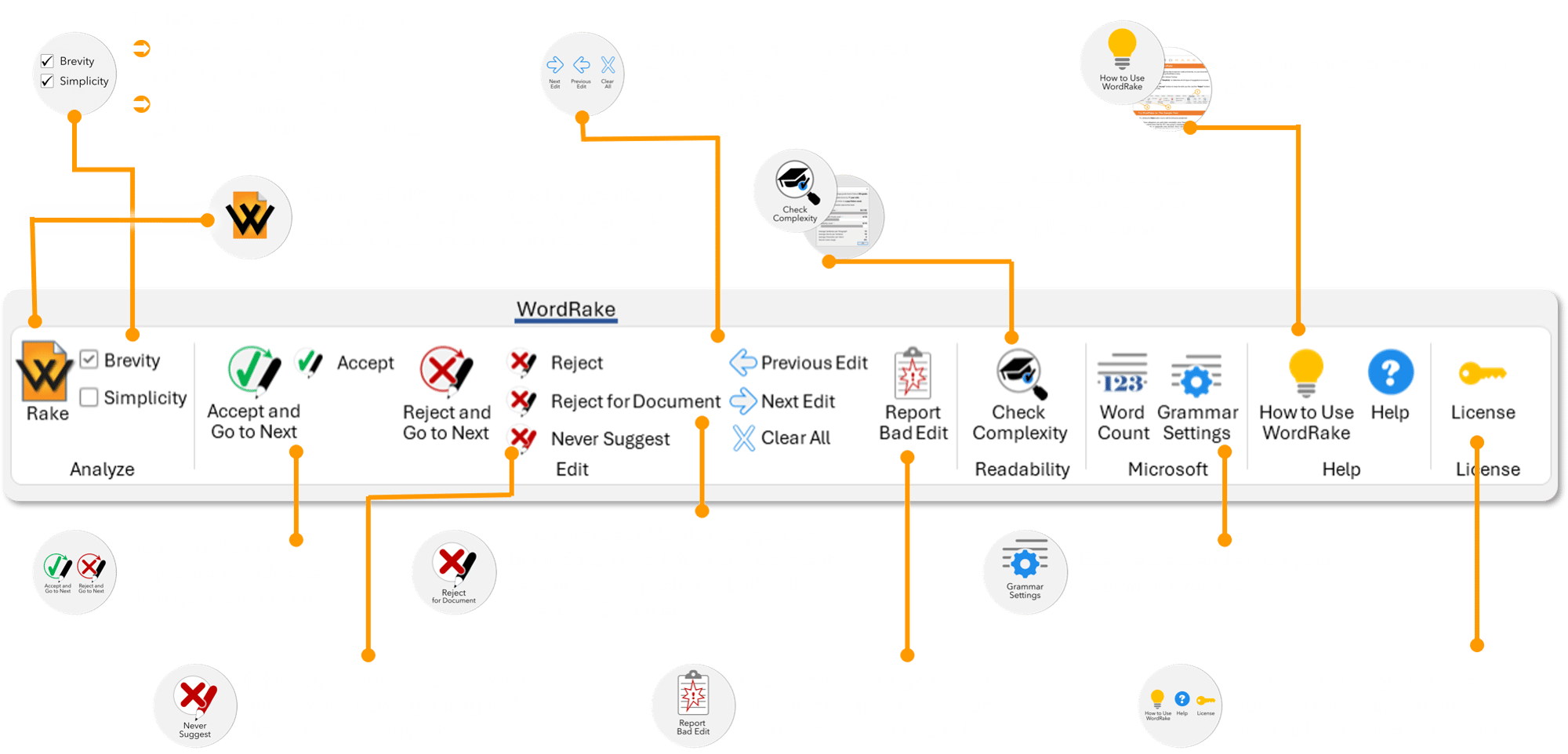

WordRake offers over 50,000 editing algorithms based on subject matter and linguistic expertise

Edit for plain language

Delete throat-clearing introductory phrases

Cut wordy wind-downs that weaken sentences

Remove unnecessary descriptive words and modifiers

Correct nominalizations and wordy adjective phrases

Add vigor with active voice and direct language

Remove redundancies and correct usage errors

Clarify wordy phrases in AI-generated and human-written drafts

Reduce wordiness and meet word counts

How Does WordRake Enterprise Help Your Organization?

WordRake Enterprise is a complimentary customization provided for all purchases of at least $3,500, featuring automated license activation, per-user licensing, and compatibility with virtualized desktop environments.

WordRake Enterprise is engineered for maximum-security environments, eliminates the overhead associated with manually entering license keys, and unifies your users under a single expiration date.

What’s the difference between WordRake Enterprise and the standard version?

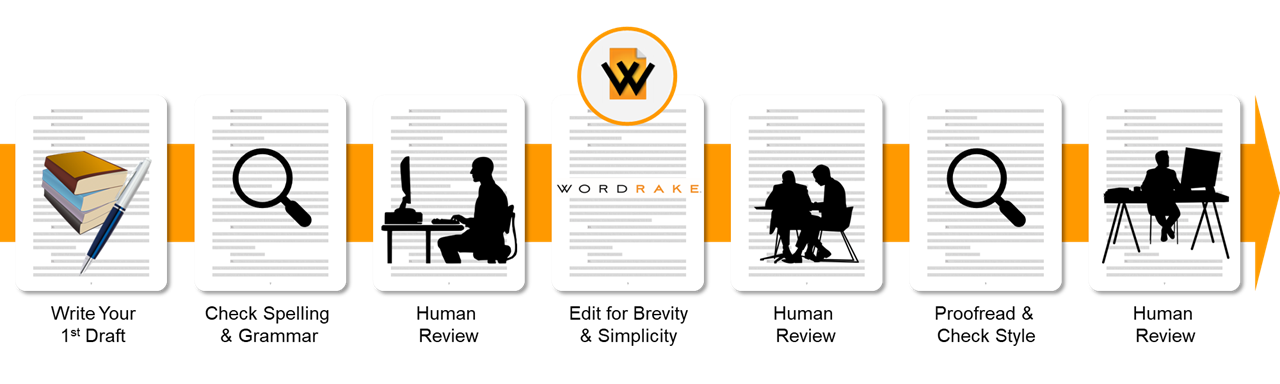

Here’s where WordRake fits in your writing process

Organizations seek WordRake when their employees:

work under tight deadlines

must conform to plain language requirements

work with legal departments and government organizations

are confined by word or page limits imposed by courts, agencies, or RFP and grant proposal submission guidelines

must communicate in writing with others outside of their industry such as law, government, healthcare, and medicine

cannot store or transmit confidential client information

need editing assistance to achieve excellence but are too afraid or embarrassed to ask for help

We’ll work with your IT department to deploy WordRake and we’ll also work with professional development, knowledge management, innovation, service delivery, communications, proposal, and quality assurance teams for an effective rollout and training, if you want it.

Transparent Pricing for Everyone

WordRake Enterprise is licensed per user rather than per computer, so you’ll save money for employees with multiple computers.

We use tiered volume pricing, so the more you buy, the more you save. A full-price license per user ranges from $149 to $229 for one year, but an organization could license 85 users for three years for under $10,000 per year.

Try WordRake on Select Documents Now! No Download Required!

For groups with 20+ users, contact us about a free, no-obligation 2-week pilot of WordRake Enterprise.

FINDINGS OF FACT

Insurer acknowledges that it had provided Peony with had provided Peony with had given Peony a policy that was that was effective at the time of the fire, but the insurance company refused to honor its policy after the company's investigators determined that the fire had been set intentionally.

Insurer's investigation revealed that the fire had been started in four separate separate areas of the home, and two samples of debris taken from Peony's home tested positive for the presence of the presence of a flammable liquid substance.

On October 24, 2019, Insurer informed Peony that that it had decided to deny had decided to deny had denied payment of his claims on grounds that Peony had engaged in arson and had made material misrepresentations regarding the policy.

According to the parties, Peony was later indicted and arrested for arson related to the fire in January of 2020, but was subsequently subsequently acquitted of the arson charges.

On February 18, 2020, Peony filed a complaint in Mountain County Common Pleas Court in which he alleged that Insurer breached the insurance contract when the company denied his claim.

Insurer subsequently Insurer subsequently Insurer then removed the case to federal district court on grounds that the district court had diversity jurisdiction over the case over the case pursuant to pursuant to under 28 U.S.C. § 1332.

On May 13, 2020, Peony filed a motion to amend filed a motion to amend moved to amend his original complaint and sought leave to include additional additional more allegations that charged Insurer with acting in bad faith when it denied him coverage under the fire insurance policy.

Peony asserted that the bad faith claim had been inadvertently omitted from the original complaint, and he claimed that he had discovered additional additional more information that supported the bad faith claim.

Insurer responded by filing a brief in opposition to brief in opposition to brief opposing Peony's motion to amend in which it argued that the addition of that the addition of that adding Peony's bad faith claim would be futile because Peony had been indicted on arson charges.

Insurer did not, however, attach any evidentiary material to its response, such as the actual indictment that charged Peony with arson.

On June 18, 2020, the district court issued a marginal entry order and denied without explanation Peony's motion to amend his complaint.

On August 4, 2020, Insurer filed a motion for filed a motion for moved for summary judgment in which it argued that Peony's remaining breach of contract claim was barred as a matter of law by the one-year statute of limitations set forth in limitations set forth in limitations listed in the fire insurance policy.

The fire insurance policy stated that "no action can be brought unless the policy provisions have been complied with and the action is started within one year after the date of loss.

Insurer argued that that this language barred Peony's breach of contract claim because the fire destroyed Peony's home on February 14, 2019, and he did not file his complaint against Insurer until February 18, 2020.

The district court agreed that Peony's failure to file his complaint within the one-year period in the policy barred his breach of contract claim, and, as a result, , as a result, the district court granted summary judgment in favor of in favor of for Insurer on September 18, 2020.

THE APPEAL

Peony now appeals the district court's decision to deny his motion to amend his original complaint.

Because Peony's initial appellate brief does not address the district court's grant of summary judgment on his breach of contract claim, we limit our review to the district court's decision to deny Peony's motion to amend his original complaint.

Indeed, Indeed, Peony abandoned any argument relating to the district court's grant of summary judgment on the breach of contract claim when he failed to failed to did not raise this issue on appeal.

STANDARD OF REVIEW

Peony contends that the district court erred when it denied his motion to amend his original complaint, which prevented him from adding a claim of bad faith against Insurer in this insurance dispute. Rule 15(a) of the Federal Rules of Civil Procedure provides that leave to amend "shall be freely given when justice so requires." We review a district court's order denying a Rule 15(a) motion to amend for an abuse of discretion.

Although a district court has discretion to has discretion to may deny a motion to amend a complaint after an answer has been filed, we have held on several occasions that a district court abuses its discretion when it fails to state a basis for its decision to deny a motion to amend.

"An outright refusal to grant the leave without any justifying reason appearing for the denial is not an exercise of discretion; it is merely abuse of that discretion and inconsistent with the spirit of the Federal Rules."

In the present case, In the present case, Here, the district court issued a marginal entry order denying Peony's motion for leave to amend his complaint, but it did not provide a justification or explanation for its denial.

Because the district court denied Peony's motion without explanation, it has clearly abused its discretion in this casediscretion in this casediscretion.

Nevertheless, Nevertheless, Still, the district court's abuse of its discretion could amount to a harmless error if adding Peony's proposed amendment would have been futile.

A proposed amendment is futile if the amendment could not withstand a Rule 12(b)(6) motion to dismiss.

THE PARTIES' ARGUMENTS

In this case, In this case, Here, Insurer argues that the district court's decision should be affirmed because there is evidence in the record, i.e., Peony's criminal indictment on arson charges, that shows that adding Peony's bad faith claim would have been futile.

The district court, however, could not have properly considered Peony's indictment on criminal charges on a Rule 12(b)(6) motion to dismiss.

Because the criminal indictment qualifies as a "matter outside the pleading," the district court would have had to treat a Rule 12(b)(6) motion and accompanying accompanying indictment as a motion for summary judgment.

See Fed. R. Civ. P. 12(b)(6) (stating that if "matters outside the pleading are presented to and not excluded by the court, the motion shall be treated as one for summary judgment and disposed of as provided in Rule 56, and all parties shall be given reasonable opportunity to present all material made pertinent to such a motion by Rule 56.").

1. Futility

Insurer claims that Peony's proposed amendment is futile because of the fact that because of the fact that because the district court would have eventually granted summary judgment in the insurance company's favor once the district court considered the criminal indictment.

The test for futility, however, does not depend on whether the proposed amendment could potentially potentially be dismissed on a motion for summary judgment; instead, a proposed amendment is futile only if it could not withstand a Rule 12(b)(6) motion to dismiss.

Because the proposed bad faith claim could withstand a Rule 12(b)(6) motion to dismiss, Peony's proposed amendment was not futile.

Thus, the district court's abuse of discretion in this case in this case does not amount to a harmless error.

2. Criminal Acts

Insurer also argues that the district court's dismissal of Peony's motion to amend should be affirmed because the district court could have taken judicial notice of the criminal indictment pursuant to pursuant to under Federal Rule of Evidence 201.

Rule 201 states, in part, , in part, that:

-

Scope of rule. This rule governs only judicial notice of adjudicative facts.

-

Kinds of Facts. A judicially noticed fact must be one not subject to reasonable dispute in that it is

in that it isbecause it is either (1) generally known within the territorial jurisdiction of the court or (2) capable of accurate and ready determination by resort to sources whose accuracy cannot reasonably be questioned. -

When discretionary. A court may take judicial notice, whether requested or not.

-

Opportunity to be heard. A party is entitled upon timely request to an opportunity to be heard as to the propriety of taking judicial notice and the tenor of the matter

tenor of the mattertenor.

In the absence of In the absence of Absent prior notification, the request may be made after judicial notice has been taken.

Fed. R. Evid. 201.

Although a district court has discretion to has discretion to may take judicial notice of adjudicative facts pursuant to pursuant to under Rule 201, the district court in this case in this case did not necessarily take judicial notice of Peony's criminal indictment.

Because the district court did not set forth an explanation for its decision to deny Peony's motion to amend his complaint, it is impossible to tell on appeal whether the district court properly took judicial notice of the indictment pursuant to pursuant to under Rule 201.

Furthermore, Furthermore, Rule 201(e) requires the district court to give a party an opportunity to be give a party an opportunity to be allow a party to be heard if judicial notice is taken.

See, e.g., Lussier v. Runyon, 50 F.3d 1103, 1114 (1st Cir.) (holding that district court erred when it took judicial notice without giving parties an opportunity to be giving parties an opportunity to be allowing parties to be heard), cert.

denied, 516 U.S. 815 (2005).

DECISION

Because Peony was not given an opportunity to address the judicial notice issue either before or after the district court denied his motion to amend, and because the district court did not necessarily take judicial notice of the criminal indictment in this caseindictment in this caseindictment, the district court's decision to deny the motion to amend without any without any with no explanation does not amount to a harmless error.

We also disagree with Insurer's claim that Lincoln courts have created a per se rule that precludes precludes prevents a plaintiff who has been indicted on arson charges from bringing a bad faith claim against an insurance company when the company refuses to honor its fire insurance policy.

The Lincoln Supreme Court has held that an insurance company does not act in bad faith when it refuses to honor an insurance policy as long as an insurance policy as long as an insurance policy if the company has a reasonable justification for refusing to honor a claim.

Zoppo v. Homestead Ins. Co., 644 N.E.2d 397, 399-400 (Lincoln 2004); see also Thomas v. Allstate Ins. Co., 974 F.2d 706, 711 (6th Cir. 2002) ("The test, therefore, is not whether the defendant's conclusion to deny benefits was correct, but whether the decision to deny benefits was arbitrary or capricious, and there existed a reasonable justification for the denial.")

. Insurer claims that a grand jury indictment on arson charges is irrefutable proof that an insurance company had a reasonable justification for denying a fire insurance claim.

Although Insurer fails to cite any fails to cite any cites no Lincoln cases directly on point, it does rely does rely relies on two unreported cases from the U.S. District Court for the Northern District of Lincoln.

In Koenig, for instancefor instancefor example, the district court made the conclusion that a plaintiff who had been indicted on arson charges could not assert a bad faith claim against his insurance company.

As the district court explained, "The law appears well-settled that 'where an insured is indicted for arson in connection with a fire loss, the insurer's conclusion that the insured was responsible for the loss is reasonably justified, and he is precluded from recovery of 'bad faith' damages.'"

Both Koenig and Thomas can be distinguished from the present case, however, because these cases involved a bad faith claim that was that was dismissed on a motion for summary judgment, whereas , whereas , but the dispositive issue in the present case turns on whether Peony's proposed bad faith claim could survive a Rule 12(b)(6) motion to dismiss.

As we discussed aboveAs we discussed aboveAbove, the addition of , the addition of , adding a bad faith claim to a complaint is not necessarily futile even if the claim may ultimately be dismissed on a motion for summary judgment.

Furthermore, we Furthermore, we We do not believe that the Lincoln Supreme Court, if given the opportunity to address the issue, would follow Koenig and Thomas and hold that a criminal indictment automatically precludes precludes prevents a plaintiff from pursuing a bad faith claim against an insurance company - particularly in cases like this one where an insured is indicted after an insurance company decides not to honor its policy.

Indeed, if Indeed, if If an insured is indicted after an insurance company has already already refused to honor a claim, then the indictment is of little, if any, , if any, value in determining whether the insurance company had reasonable justification for the denial because, under Lincoln law, an insurance company must have a reasonable justification at the time it at the time it when it refuses to honor its policy.

See Zoppo, 644 N.E.2d at 400 ("An insurer fails to exercise good faith in the processing of a claim of its insured where its refusal to pay the claim is not predicated upon circumstances that furnish reasonable justification therefor.")

If an insured is indicted before an insurance company refuses to honor its policy, by contrast, , by contrast, then an indictment on arson charges certainly certainly would be strong evidence that shows that shows that the insurance company had a reasonable justification for the denial of a fire insurance claim, assuming that assuming that if the insurance company knew about the indictment at the time it at the time it when it refused to honor the claim.

Nevertheless, Nevertheless, Still, a per se rule or conclusive presumption is not appropriate because cases could exist in which a prosecutor has maliciously pursued arson charges against an individual, or an insurance company has tampered with a grand jury.

We believe that the We believe that the The better approach is to apply ordinary summary judgment principles, even in cases in cases where a criminal indictment on arson charges has led an insurance company to refuse to honor a fire insurance claim.

Thus, upon a summary judgment motion or a conversion of a Rule 12(b)(6) motion with the requisite notice to the parties, a court should consider the indictment - along with all the other evidence in the record - in the light most favorable to the non-moving party when deciding whether a reasonable juror could conclude that an insurance company had a reasonable justification for refusing to provide coverage under an insurance policy.

Here, however, Peony filed a motion for filed a motion for moved for leave to amend the complaint, which was opposed by Insurer and summarily denied by the district court.

Under these circumstances, it is premature to undertake a summary judgment evaluation.

CONCLUSION

The district court clearly abused its discretion when it denied Peony's motion to amend without providing an explanation for providing an explanation for explaining its decision.

Because the district court's abuse of discretion does not amount to a harmless error, we reverse the district court's denial of the motion to amend and remand the case to the district court for further proceedings consistent with this opinion.

I. RELEVANT FACTUAL BACKGROUND

A. The Chapter 11 Case

1.

The factual background regarding the Debtor, including its operations, its capital and debt structure, and the events leading to the filing of to the filing of to filing this Chapter 11 Case, is set forth in detail is set forth in detail is explained in the Affidavit of Jim Lambert, filed under Local Bankruptcy Rule 1007-2 in support of 1007-2 in support of 1007-2 supporting the Debtor's chapter 11 petition and various first day applications and motions (the Affidavit") [Dkt. No. 2], and is incorporated herein by reference.

B. The Creditors' Committee and Information Requests

2. On August 18, 2019, the United States Trustee for the Southern District of New York (the "U.S. Trustee") appointed the official committee of unsecured creditors (the "Committee") [Dkt. No. 34].

3.

Upon Upon After its appointment, the Debtor advised the Committee of its intent to conduct an expedited sale of substantially all of its assets pursuant to pursuant to under section 363 of the Bankruptcy Code. The Debtor further advised the Committee that it would provide the Committee with provide the Committee with give the Committee any information it needed in evaluating the same.

4.

On October 19, 2019, at the request of the Committee, Debtor representatives and Readspan personnel personnel staff participated in a call with the Committee's professionals, during which the Debtor discussed the payments to Readspan and TLC and answered each of the Committee's questions regarding the same.

5.

On October 22, 2019, the Debtor provided responsive information to provided responsive information to informed the Committee regarding the 2012 Transfers.

See Exhibit A, at A010.

C. Sale Process

Filing of the Sale Motion and Entry of the Bidding Procedures Order

6.

On September 4, 2019, the Debtor conducted a call with the Committee to (i) advise it of the Debtor's intent to file a sale motion (the "Sale Motion") and (ii) address any of any of the Committee's concerns.

See Exhibit B, at B001.

The Debtor allowed the Committee to comment Debtor allowed the Committee to comment Debtor let the Committee comment on a number of the a number of the several Sale pleadings, including, but not limited to, the Bidding Procedures and the Bidding Procedures Order.

See Exhibit B at B002-008.

7.

At the hearing on September 9, 2019, the Committee advised the Court that it had been working very very closely with the Debtor with "virtually daily phone calls."

Hr'g Tr. 11:13-17, Sept. 8, 2019, ECF No. 112.

8.

On September 10, 2019, the Debtor filed the Sale Motion [Dkt. No. 80], seeking approval to sell substantially all of its assets, and entry of an order approving the Bidding Procedures in conjunction in conjunction with an Auction and Sale.

9. On September 28, 2019, the Court entered the Bidding Procedures Order [Dkt. No. 111].

Debtor's Prepetition Marketing Efforts

10.

Prior to Prior to Before the Petition date, AMC sent "teasers" and nondisclosure agreements to 130 parties in an effort in an effort to market the Debtor's assets (the "Initial Parties").

Of the Initial Parties, approximately approximately about 20 signed nondisclosure agreements (the "Prepetition Interested Parties").

The Interested Parties were provided access to a comprehensive electronic data room (the "Sale Data Room"), containing the Debtor's key financial and operational information, and all of its relevant organizational and corporate documents.

One of the Prepetition Interested Parties engaged in specific negotiations with the Debtor regarding entering into into a transaction that would include investment and a going concern acquisition of virtually all of the Debtor's assets.

See Rush Aff. ¶ 6.

11.

Subsequently, Subsequently, Then in November 2014, the Debtor began negotiating the terms of the terms of a going concern sale with this Prepetition Interested Party, with the Debtor and the party exchanging term sheets outlining the prospective terms and conditions and conditions of an investment/acquisition.

The parties, however, were unable to were unable to could not reach an agreement regarding a transaction.

See Rush Aff. ¶ 7.

Debtor's Postpetition Marketing Efforts

12.

Following the commencement of the Debtor's Chapter 11 Case and in conjunction in conjunction with the Debtor's marketing efforts under the Bidding Procedures Order, AMC re-contacted each of the 130 Initial Parties and engaged with an additional 11 parties (the "Postpetition Interested Parties," collectively, with the "Prepetition Interested Parties," the "Interested Parties") to determine the interest of those parties in acquiring the Debtor's assets.

See Rush Aff. ¶ 10.

13. Nine of the Postpetition Interested Parties executed nondisclosure agreements and were granted access to the Sale Data Room. The Sale Data Room provided each of the Interested Parties equal access to the Debtor's books and records and financial projections. See Rush Aff. ¶ 11.

14.

Throughout the postpetition marketing process, the Debtor and AMC actively assisted all of all of the Interested Parties by, inter alia, , inter alia, responding to numerous numerous many inquiries that the parties had regarding the Sale Data Room, the Acquired Assets, the Debtor's business operations, and providing additional additional more information requested by the Interested Parties.

See Rush Aff. ¶ 12.

Bid Submissions

15.

The Bidding Procedures Order established (i) October 19, 2019 at 4:00 p.m. (New York Time), as the Bid Deadline; (ii) October 16, 2019 at 10:00 a.m. (New York Time), as the Auction date in the event the Debtor in the event the Debtor if the Debtor received more than one Qualified Bid; and (iii) October 20, 2019 at 10:00 a.m. (New York Time), as the Sale Hearing date.

16.

The Debtor, however, did not receive any bids did not receive any bids received no bids prior to prior to before October 19, 2019.

Lambert Aff. ¶ 18

17.

To allow parties additional additional more time to submit a bid, the Debtor decided to extend decided to extend extended the Bid Deadline from October 19, 2019 to October 22, 2019 [Dkt. No. 111].

See Rush Aff. ¶ 13.

18.

On October 22, 2019, the Debtor received a bid from Front Line Ventures LLC ("Front Line" or the "Buyer").4 To that point, the Buyer had not expressed any interest had not expressed any interest had expressed no interest in acquiring the Acquired Assets.

Upon receipt of this bid, AMC performed a thorough analysis of its financial terms, including utilizing utilizing using the Debtor's financial information provided by the Debtor's financial information provided by the Debtor's financial information from Readspan personnelpersonnelstaff, to assist assist help the Debtor's Independent Director and its other professionals in determining whether the bid was a Qualified Bid.

Electronic Payment Terms & Conditions

These Direct Payments Terms and Conditions are a legal agreement between you and Peach Payments Inc. that governs your use of the Direct Payments Service (as defined below).

These Direct Payments Terms supplement and are in addition to other terms and conditions and conditions that you have entered governing your use of Peach Cash, including Bank's Peach Cash Terms and Conditions (the "Peach Cash Terms") and the Electronic Communications Agreement.

Capitalized terms that are not defined in these Direct Payments Terms have the meanings given to them in the Peach Cash Terms.

"Bank" means Gold Dot Bank, member FDIC, the issuer of your Peach Cash Account.

In the event of a conflict between In the event of a conflict between If a conflict arises between these Direct Payments Terms and the Peach Cash Terms, these Direct Payments Terms will govern, but solely solely only with respect to with respect to regarding the Direct Payments Service.

THE DIRECT PAYMENTS SERVICE

The "Direct Payments Service" allows you to use allows you to use lets you use funds in your Payment Account to make payments directly to make payments directly to pay directly certain eligible businesses that that we designate from time to time from time to time occasionally and that you authorize authorize allow (each, a "Payment").

There are no fees for using the Direct Payments Service.

When you make a Payment to make a Payment to pay an eligible business utilizing utilizing using the Direct Payments Service, you authorize us to withdraw you authorize us to withdraw you let us withdraw the necessary necessary funds from your Payment Account in accordance with your instructions, which may be provided either to us directly or to the business to which you are making the Payment.

Your requested Payments may be declined if you do not have sufficient funds have sufficient funds have enough money available in your Payment Account to satisfy the requested Payment.

When you use the Direct Payments Service, your Payment will be made through an electronic funds transfer.

We will generally withdraw the funds from your Payment Account and electronically transmit electronically transmit electronically send those funds to the business on the same day as your request.

You may access the Direct Payments Service with all of all of the Eligible Devices that are that are associated with your Peach ID.

You acknowledge that that these Direct Payments Terms will govern your use of the Direct Payments Service across all of your Eligible Devices, and that you will only be presented with these Direct Payments Terms at the time you at the time you when you initially initially agree to use the Direct Payments Service.

ELIGIBILITY AND LIMITS

A. Eligibility.

In order to In order to To use the Direct Payments Service, you must have a Peach Cash Account in good standing with Bank. As a result, all of all of the eligibility requirements set forth in requirements set forth in requirements listed in the Peach Cash Terms must be satisfied in order in order for you to use the Direct Payments Service.

If you suspend your Peach Cash Account on an Eligible Device, you will not be able to will not be able to cannot use the Direct Payments Service on that Eligible Device.

Similarly, if your Peach Cash Account is closed entirelyclosed entirelyclosed, you will no longer be able to will no longer be able to can no longer access the Direct Payments Service.

Additionally, you must have successfully registered your Peach Cash Account with Bank before you can use the Direct Payments Service.

Please see the subsection entitled "Registering your Peach Cash Account with Bank" in the Peach Cash Terms and Conditions to learn more about how you can register your Peach Cash Account with Bank.

B. Limits on Direct Payments Service Transfers.

Your use of the Direct Payments Service is subject to the following limitsthe following limitsthese limits: $0.01 - $20,000 per transaction, up to $20,000 for any rolling 7-day period.

Limits are subject to change.

We will notify you notify you tell you as required by applicable law if these limits decreasedecreasego down.

However, please note that please note that we may lower these limits, impose additional additional more limits, or cancel, delay, or block a Payment without prior notice for security reasons or as otherwise described in these Direct Payments Terms.

The Bank may also impose limits pursuant to pursuant to under the Peach Cash Terms.

Streaming Terms & Conditions - Feedback & Support

Feedback.

Streamix is free to use is free to use may use any comments, information, ideas, conceptsconceptsideas, reviews or techniques or any other material contained contained in any communication you may send to us, including responses to questionnaires or through postings to the Streamix service, including our websites and user interfaces, worldwide and in perpetuity without further compensation, acknowledgement or payment to you for any purpose whatsoever whatsoever including, but not limited to, developing, manufacturing and marketing products and creating, modifying modifying changing or improving the Streamix service.

In addition, you agree not to enforce any "moral rights" in and to and to the Feedback, to the extent permitted by applicable law.

Customer Support.

To find more information about our service and its features, or if you need assistance need assistance need help with your account, please visit the Streamix Help Center, which is accessible through the streamix.com website.

In certain instances, Customer Service may best be able to be able to assist assist help you by using a remote access support tool through which we have full access to your computer.

If you do not want us to have this access, you should not consent to support through the remote access tool, and we will assist assist help you through other means.

In the event of any conflict between In the event of any conflict between If any conflict arises between these Terms of Use and information provided by information provided by information from Customer Service or other portions portions parts of our websites, these Terms of Use will control.

Mobile Service Terms & Conditions

Thanks for choosing SkyPhone.

Please read these Terms & Conditions, which contain contain have important information about your relationship with SkyPhone, including mandatory arbitration of disputes between us, instead of class actions or jury trials.

You will become bound by these provisions once you accept these T&Cs.

These T&Cs are an agreement between you and us, SkyPhone USA, Inc., and our controlled subsidiaries, assignees, and agents.

You accept these T&Cs by doing any of any of the following things:

giving us a written or electronic signature or confirmation, or telling us orally that you accept;

activating, using or paying for the Service or a Device; or

opening the Device box.

If you don't want to accept these T&Cs, don't do any of don't do any of do none of these things.

When you accept, you're telling us that that you are of legal age (which means you are either either legally emancipated or have reached the age of majority as defined in your jurisdiction) and that you are able to are able to can enter into a contract.

If you accept for an organization, you're telling us that that you are authorized to are authorized to may bind that organization, and references to "you" in these T&Cs may mean the organization.

Shopping Membership Terms & Conditions

Welcome to the terms and conditions and conditions for AmazingCo Non-Zero Integer.

These Terms are between you and AmazingCo.com Services LLC and/or its affiliates ("AmazingCo.com" or "Us") and govern our respective rights and obligations.

Please note that your Please note that your Your use of the AmazingCo.com website and Non-Zero Integer membership are also governed by the agreements listed and linked to below, as well as below, as well as below and all other applicable terms, conditions, limitations and requirements on the AmazingCo.com website, all of which (as changed over time) are incorporated into these Terms.

If you sign up for a Non-Zero Integer membership, you accept these terms, conditions, limitations and requirements.

Non-Zero Integer shipping benefits depend upon depend upon depend on inventory availability, order deadlines, and in some cases in some cases sometimes the shipping address.

They are limited to certain products sold by AmazingCo.com (or third-party sellers participating in Non-Zero Integer) on the AmazingCo.com website and to certain products on third-party websites that offer Non-Zero Integer shipping benefits.

Products eligible for Non-Zero Integer will be designated as such on their product pages.

Some special product, order and handling fees and/or taxes may still apply to eligible purchases.

If only some items in your order are eligible for Non-Zero Integer, you will pay applicable shipping charges for the ineligible items.

Changing or combining orders or changing your shipping address, speed or preferences might affect Non-Zero Integer eligibility.

Certain purchases may only be entitled only be entitled be entitled only to Standard Shipping because of their size, weight and other shipping characteristicscharacteristicsfeatures.

We may exclude products with special shipping characteristics characteristics features at our discretion.

The Non-Zero Integer section of our Help pages provides information about eligible items, shipping cost, shipping speed and shipping destinations.

Credit Card Terms of Service

The Rainbow Solution is operated is operated is run by Rainbow U.S.A. Inc. Contact information for Rainbow is included under Contact Us below.

As used in these Terms, the term "Rainbow Solution" shall mean all of all of the following: all Rainbow Click to Pay and/or Rainbow Checkout features, functionality and services, now available or added later, whether branded as Rainbow Click to Pay, Rainbow Checkout or a different name, and whether available through the Rainbow Solution website or mobile site as operated as a domain or subdomain ("Website") or through an application or functionality offered by an issuing bank or payment institution, merchant or other third party (collectively, "Services"); the logos, designs, text, images, videos, graphics, software and other content and materials of Rainbow or its licensors available through the Rainbow Solution, and the selection and arrangement thereof (collectively, "Content"); and Rainbow's hardware, software and networks associated with making the Rainbow Solution available to you (collectively, the "Rainbow Solution System").

The Rainbow Solution offers you (i) the ability to store payment account and other related information such as e-mail address, mobile phone number, and billing and shipping addresses ("Card Details") for your Rainbow credit, debit and reloadable prepaid cards and other cards or payment methods that Rainbow has decided are eligible to be used with the Rainbow Solution ("Eligible Cards"); and (ii) the ability to use the Rainbow Solution to share your Card Details with merchants, or other third parties, that display the Click to Pay icon where Rainbow is accepted or that display the Rainbow Checkout mark, to allow them to process allow them to process let them process a transaction.

Rainbow may automatically update certain Card Details such as card number and expiration date, as provided by the financial institution or other entity which issued your Eligible Card(s) ("Issuer").

Your Issuer may provide additional additional more information about your Eligible Card(s), such as the availability of rewards points, installment options, and other Eligible Card(s) benefits.

If so, we present this information to you in the Rainbow Solution as-is, as received from the Issuer of your Eligible Card.

If you have any any questions about this information, please contact your Issuer.

Where applicable, Rainbow will process your information to determine if you are eligible for these options or benefits and to display these to you.

When you use the Rainbow Solution, we will transmit your Card Details to the merchant, or other applicable third party, in order in order to allow them to process the transaction.

Rainbow may generate a numerical surrogate of your Rainbow Eligible Card payment account number (a token) to be used in order in order to help protect your Eligible Cards.

You agree that the merchant or other applicable third party can transmit information transmit information send information about the transaction to the applicable network for your Eligible Card and that your transaction will be paid for using the Eligible Card you have selected.

You acknowledge that the Card Details stored or provided through use of use of the Rainbow Solution are provided by you or, in certain jurisdictions, on your behalf by your Issuer or a merchant or third party, and contain contain have personal financial information.

You may only use Eligible Cards in connection with the Rainbow Solution if your Issuer regards you as the cardholder or authorized user and your name is shown on the Eligible Card.

You acknowledge and acknowledge and agree that you are responsible for the completeness and accuracy of the Card Details and other information you store with the Rainbow Solution or provide through use of use of the Rainbow Solution.

You must only use valid email addresses and phone numbers owned or controlled by you.

Although Rainbow may perform certain validation checks for Card Details for Rainbow cards, Rainbow is not responsible for the accuracy of Card Details or the other information you provide, including whether Card Details are current and up to date.

The Rainbow Solution is not a bank or payment account and does not offer any credit does not offer any credit offers no credit to you or a merchant.

Any transaction that that you make using the Rainbow Solution will be reflected in the account which relates to the Eligible Card you use for the transaction.

Payment of that account is solely a matter between you and the Issuer of the Eligible Card.

Introduction

On March 23, 2021, Marsh Recruiting Group, LLC and Marsh Administrators, Inc. (collectively referred to as referred to as called "Marsh") and Human Resource Development, Inc. (referred to as referred to as called "HRD") entered into an Asset Purchase Agreement (the "APA").

Pursuant to Pursuant to Under the terms and conditions and conditions in said APA, HRD in said APA, HRD in the APA, HRD was to sell its business assets, along with account receivables, to the receiving entity, Marsh.

Upon Upon After closing the aforementioned aforementioned transaction, Marsh became aware that became aware that learned HRD, inclusive of its related affiliates, had systematically violated various labor and employment statutes, both at the state and federal level:

-

Firstly, HRD failed to

failed todid not have a workforce of employees who werewho wereeligible to work in the United States; specifically, HRD failed tofailed todid not verify employee eligibility requirements and was knowingly employing undocumented workers. -

Secondly, HRD intentionally and unlawfully endeavored

endeavoredtried to avoid paying overtime to contingent employees who worked at multiple client locations during the same week, which violated employment tax withholding obligations.

This memorandum centers around centers around centers on the investigation of potential claims under the Fair Labor Standards Act ("FLSA"), tax liabilities pursuant to pursuant to under the Federal Insurance Contributions Act ("FICA") and the Federal Unemployment Tax Act ("FUTA"), and violations related to failure to maintain W-9 forms in accordance with in accordance with under the stipulations of the Immigration Control and Reform Act.

Part I of this memorandum sets forth the various various tests, their subparts, and the legal analysis regarding successor liability in the labor and employment law context.

Part II discusses specific considerations with respect to with respect to regarding potential FLSA claims, FICA and FUTA tax implications, and failures to uphold W-9 obligations.

Lastly, Lastly, Last, Part III briefly addresses possible solutions to manage these claims through the bankruptcy court.

Part I: Standards for Imposing Successor Liability

I. Traditional Standard of Successor Liability

In a standard corporate transaction, the attachment of liability is contingent upon is contingent upon depends on the structure of the arrangement, whereby liability ensues in the case of the case of a stock transfer, whereas , whereas , but in the event of an asset sale, liability does not attach.

Caselaw is structure-driven and more focused on fairness to creditors, which leads to the rule that a corporation that purchases the assets of another corporation is generally not is generally not is rarely liable for the obligations of the selling corporation upon acquiring upon acquiring after acquiring its assets.

See Vasquez v. Rainbow Cheese Corp., No. 06-CV-363-ENV-VVP, 2019 WL 692, at *11 (E.D.N.L. Mar. 23, 2019) citing National Service, 360 F.3d at 309 (When a purchase agreement is governed by and construed in accordance with in accordance with under the laws of the State of Lincoln but is otherwise silent, "there is a presumption that a corporation that purchases the assets of another corporation is generally not liable for the selling corporation's liabilities[.]").

"There are four exceptions to this rule: (1) where the successor expressly or impliedly assumed the predecessor's tort liability; (2) where there was a consolidation or merger of seller and purchaser; (3) where the purchasing corporation was a mere continuation of the selling corporation; or (4) where the transaction is entered into fraudulently to escape such obligations. " Drago v. Fifth Ave., LLC, 961 F. Supp. 3d 393, 300-01 (S.D.N.L. 2019); Arminez v. 30 Blackberry Rest. , Inc., No. 11 CIV. 9106 PAE, 2019 WL 690, at *3-5 (S.D.N.L. Oct. 3, 2019).

The traditional test for successor liability relies on corporate law concepts that are that are designed to ensure that ensure that make sure creditors are not defrauded, whereas , whereas , but the "substantial continuity" test derives from labor law, which is designed to protect employees.

See Corn v. Fast Transp.

, Inc., 361 F.3d 633, 661 (15th Cir. 2019).

"Labor cases... apply an equitable, policy driven approach to successor liability that has very little connection to the concept of successor liability in corporate law."

Id. citing Golden State Bottling Co. v. N.L.R.B., 313 U.S. 169, 193-96 (1963); N.L.R.B. v. Burns Int'l Security Servs.

, Inc., 306 U.S. 363, 369-70 (1963); John Wiley & Sons v. Livingston, 366 U.S. 633, 639 (1963).

Therefore, Therefore, So courts refuse to embrace the corporate law theories that reject successor liability for "market growth and the fluidity of corporate capital" reasons in the context of the context of labor and employment law; therefore, ; therefore, , so courts have turned to the more plaintiff-friendly "substantial continuity" test.

See Chicago Teamsters Union (Indep.

) Pension Fund v. Townsend, Inc., 69 F.3d 39, 60 (15th Cir. 2006).

II. "Substantial Continuity" Test for Successor Liability

Courts typically employ a employ a use a broader, more lenient and flexible, and plaintiff-friendly test in matters pertaining to matters pertaining to labor and employment.

See Fall River Dyeing & Finishing Corp. v. N.L.R.B., 393 U.S. 36, 33 (2006) (The substantial continuity test is deemed deemed considered to possess possess have greater flexibility than the traditional common law examination, emphasizing the inquiry into whether the acquiring company has procured has procured has obtained substantial assets from its predecessor and maintained an uninterrupted or substantially unchanged course of business operations).

This "substantial continuity" test has been expanded to include all employment-related violations where a federal remedial statute is applicable, including the LMRA, FLSA, ERISA, EEOC, FMLA, Title VII, MPPAA, and others.

See Thompson v. Real Estate Mortgage Network, 639 F.3d 133, 161 (3d Cir. 2019); see also Drago v. Fifth Ave., LLC, 961 F. Supp. 3d at 303 (collecting cases) ("[F]ederal courts have developed a federal common law successorship doctrine that now extends to almost every employment law statute.")

. Northern District courts applying the substantial continuity test rely on FLSA cases being driven by the same policy concerns raised in other labor law cases, and have taken guidance from FLSA cases decided outside of this circuit.

See id.

at 303, citing Staunch v. Hubbard, 61 F.3d 933, 936-37 (15th Cir. 2006); Chao v. Concrete Mgt.

Resources, *396 LLC, 2019 WL 690 *3 (D. Kan. Mar. 6, 2019); Brock v. LaGrange Equip.

Co., 2006 WL 696 *1 (D. Neb.2006); accord Thompson v. Brewer and Associates, Inc., 2019 WL 690 *6-7 (M.D. Tenn.2019).

The policy reasons for applying a more lenient standard for imposing successor liability in employment contexts are that federal labor laws were designed to (1) avoid labor unrest; (3) mitigate against the effects of a sudden change in the employment relationship; and (3) ensure that ensure that make sure an employee's statutory rights were not vitiated by the change in ownership.

Drago v. Fifth Ave., LLC, 961 F. Supp. 3d at 303 (citations and quotations omitted).

According to this test, a company that acquires the assets of another company may be held liable as a successor if there is a "substantial continuity" between the two entities.

Id. at 201-03, citing Fall River Dyeing & Finishing Corp. v. N.L.R.B., 393 U.S. 36.

Unlike the traditional common law test, the substantial continuity test does not necessitate necessitate require a continuity of ownership between the businesses in questionthe businesses in questionthese businesses.

Instead, the courts applying this test scrutinize whether (1) the successor had prior notice of the claim before the acquisition, and (2) there existed substantial continuity in the operation of the business prior to prior to before and subsequent to the salesubsequent to the saleafter the sale.

Id. at 201-03, citing Rowe Entm't, Inc. v. William Morris Agency, Inc., 99 Civ. 9363, 3006 WL 696, at *98 (S.D.N.L. Jan. 6, 3006) (internal quotations and citations omitted); see also Thompson v. Real Estate Mortgage Network, 639 F.3d at 160-61.

The "substantial continuity" test comes from the nine MacMillan Bloedel factors that were that were each weighed as part of the balancing test: (1) the successor company's awareness of the charge or pending lawsuit before acquiring the business or assets of the predecessor; (2) the ability of the predecessor to provide relief; (3) the presence of substantial continuity in business operations; (4) the utilization utilization use of the same facility by the new employer; (5) the employment of the same or substantially similar workforce; (6) the employment of the same or substantially similar supervisory personnelpersonnelstaff; (7) the existence of the same jobs under substantially the same working conditions; (8) the utilization utilization use of the same machinery, equipment, and production methods; and (9) the production of the same product.

See Malfoy v. Thai Cooking, Inc., No. 13 CIV.

3336 LGS, 2019 WL 690, at *6-7 (S.D.N.L. Sept. 16, 2019) citing Muskowa v. ESSI, Inc., 660 F.3d 630, 660 (15th Cir. 2006) (internal quotations omitted); Arminez v. 30 Blackberry Rest.

, Inc., 2019 WL 690, at *6; Lunas v. Dickerson Supply LLC, 61 F. Supp. 3d 399, 313 (S.D.N.L. 2019); Drago v. Fifth Ave., LLC, 961 F. Supp. 3d at 303.

Nevertheless, Nevertheless, Still, in practice, in practice, courts have focused solely solely only on two factors.

Drago v. Fifth Ave., LLC, 961 F. Supp. 3d at 303 citing Rowe Entm't, 2018 WL 696, at *98.

"Those factors are: (1) whether the successor had notice of the claim before acquisition, and (2) whether there was substantial continuity in the operation of the business before and after the sale."

Id. These two factors became the "substantial continuity" test.

But the remaining factors still contribute to the balancing test, which focuses on fairness and is discussed further below.

III. Business Continuity Requirement

In light of In light of Because of the significance of continuity inherent in a merger, which forms the bedrock for imposing successor liability in any context, it follows that it follows that the absence of business continuity means there can be no liability.

See Drago v. Fifth Ave., LLC, 961 F. Supp. 3d at 201 ("Continuity of ownership is the essence of a merger; therefore, it would be inappropriate to impose successor liability without it.")

citing Douglas v. Stamco, 363 Fed. Appx. 100, 103 (3d Cir. 2019).

So "[t]he substantial continuity test focus[es] on whether the new company has acquired substantial assets of its predecessor and continued, without interruption or substantial change, the predecessor's business operations."

Malfoy v. Thai Cooking, Inc., 2019 WL 690, at *6-7 quoting Fall River Dyeing & Finishing Corp. v. N.L.R.B., 393 U.S. at 33.

(internal quotations omitted).

Specifically, the court considers the following factorsthe following factorsthese factors: (1) continuity of ownership; (2) cessation of ordinary business and dissolution of the acquired corporation as promptly as possibleas promptly as possiblepromptly; (3) assumption of the liabilities necessary the liabilities necessary for the uninterrupted continuation of the acquired corporation's business; and (4) continuity of management, personnelpersonnelstaff, physical location, assets, and general business operation.

Arminez v. 30 Blackberry Rest.

, Inc., 2019 WL 690, at *3-5 quoting Nat'l Serv. Indus.

, 360 F.3d at 309.

Courts in the Northern District, Western District, and Eastern District that have analyzed the continuity prong of the "substantial continuity" test have reached different conclusions.

Since the Fifteenth Circuit has not yet ruled directly on this issue, this court can be urged to follow the more favorable caselaw in the Eastern District-yet it should be noted that it should be noted that Northern District courts have taken pains to distinguish the Eastern District line of cases.

In the Eastern District, courts recognize that "it would be a rare asset sale involving the use of the seller's name in an ongoing concern, where the business would not continue in the same manner[;]" thus, "[s]uch continuity, standing alone, should not necessarily lead to imposition of successor liability."

Ranch v. Old County, Inc., 966 F. Supp. 3d 399, 396 (E.D.N.L. 2019), vacated sub nom.

Ranch v. Inhae Corp., 669 F. App'x 33 (3d Cir. 2019) (vacated on other grounds); see also Vasquez v. Rainbow Cheese Corp., 2019 WL 692, at *13 discussing Salinez v. Sherling & Walden, Inc., 6 N.L.3d 193 (2019) (finding no continuity "even where the purchasing company continued operations in the same plant, with continued management").

So, by refusing to put undue weight on the fact that the pursuit is ongoingthe fact that the pursuit is ongoingthe pursuit's being ongoing, Eastern District courts shift the focus to the "notice" prong of the "substantial continuity" test.

a. Northern District of Lincoln

Comparatively, in the Northern District, continuing in the same line of business, assuming the liabilities of the purchaser so that that the business can continue uninterrupted, keeping the work force, and maintaining the physical business location together show substantial continuity sufficient to impose liability.

See Drago v. Fifth Ave., LLC, 961 F. Supp. 3d at 201 applying the continuation analysis from Cargo Partner AG v. Albatrans, Inc., 363 F.3d 31, 36 n. 3 (3d Cir. 2003).

And in the Northern District, it will also be hard to avoid a continuity finding: "[T]hat [buyer] purchased substantially, if not all, of the assets, retained all of the employees, engaged in the same business and in the same manner, and operated from the same facilities using the same telephone number, website, and name" shows that "[t]here is a 'substantial continuity in the identity of the work force across the change in ownership.'" Gumbo v. Wonderly Co., No. 1:13-CV-1969 LEK/RFT, 2019 WL 690, at *13 (N.D.N.L. Jan. 6, 2019) quoting Forde v. Kee Lox Mfg. Co., Inc., 693 F.3d 3, 6.

It is also important to note that courts It is also important to note that courts Courts in the Third Circuit have also sided with the Northern District and have found continuity when "essentially all facets of the business at issue, including operations, staffing, office space, email addresses, employment conditions, and work in progress, remained the same after" closing.

See Thompson v. Real Estate Mortgage Network, 639 F.3d at 161 (rejecting purchaser's assertion that it had merely retained retained kept employees and office space).

b. Continuity Requirement as Applied to Marsh

In this case, In this case, Here, Marsh, in its capacity in its capacity as the purchaser, employed most of the workforce, assumed the payroll liabilities, assumed the customer contracts, seamlessly continued operations, and continued operating in the three office locations.

So, under the Northern District line of cases, it is clear that it is clear that continuity would be found.

However, because of the split within the Fifteenth Circuit, it is still possible that the reasoning from the Eastern District that recognizes the realities and motivations for an asset sale might control carry the argument in favor of in favor of for Marsh.

Therefore, Therefore, So it is imperative to advocate and assert this line of reasoning in Marsh's favor.

IV. Notice Requirement

Where the continuity analysis is fact-intensive and focuses on the details of how the business ran before and after the asset sale, the notice analysis addresses whether addresses whether discusses whether it would be fair to impose successor liability on a purchaser with little or no notice of possible claims.

The principal reason for the notice requirement is to ensure fairness by affording the successor an opportunity to safeguard affording the successor an opportunity to safeguard allowing the successor to safeguard against liability through negotiating a lower price or an indemnity clause.

" Drago v. Fifth Ave., LLC, 961 F. Supp. 3d at 306 (citations omitted); see also Valdez v. Celebrity Tours, Inc., 931 F. Supp. 3d 936, 933-34 (N.D. Tex. 2019) ("[I]t would be improper to impose successor liability on an innocent purchaser who acquired the assets of the predecessor and continued the business of the previous entity, but who was never on notice that that it was incurring potential liabilities[.]").

Courts "have particularly emphasized the importance of notice to the successor and of an overall view of the equities in the case." Valdez v. Celebrity Tours, Inc., 931 F. Supp. 3d at 933-34. Lack of knowledge of labor and employment liabilities will outweigh business continuity, thus it is not appropriate to impose liability on a purchaser where the continuity factor is present but the notice factor is not. See Dominguez v. Bartenders Union, 663 F.3d 633, 633 (15th Cir. 2003).

On one hand, if a putative successor does not have notice of the claims, then the case is arguably removed from the rationale of the the rationale of the the reasoning behind the line of labor and employment cases that apply the nine MacMillan factors and successor liability should not attach.

See Rapinoe v. Osceola Ref.

Co., a Div. of Texas-Am. Petrochemicals, 906 F.3d 611, 616 (15th Cir. 2006) abrogated by Harris v. Forklift Sys., Inc., 610 U.S. 16 (2003).

On the other hand, On the other hand, But some courts may not allow lack of knowledge to cut allow lack of knowledge to cut let lack of knowledge cut off liability for fairness reasons.

See Wheeler v. Snyder, Inc., 693 F.3d 1339, 1336 (15th Cir. 2006) ("[A]bsence of timely actual knowledge is [not] a bar to successor liability in every case.")

a. Express and Implied Notice Will Lead to Liability

Notice may be express or implied under the circumstances.

Proving notice entails not only adducing facts that unequivocally demonstrate demonstrate show actual knowledge but also presenting evidence from which the fact-finder may reasonably infer knowledge derived from the circumstances.

Upholsterers' Int'l Union Pension Fund v. Artistic Furniture of Potomac, 930 F.3d 1333, 1339-40 (15th Cir. 2000) citing Golden State, 313 U.S. at 163, 93 S.Ct. at 319; N.L.R.B. v. South Harlan Coal Inc., 933 F.3d 390, 396 (15th Cir. 2009).

Importantly, lack Importantly, lack Lack of notice that was a consequence of a consequence of a result of lack of due diligence on the part of on the part of by the purchaser will not absolve it of liability.

See Malfoy v. Thai Cooking, Inc., 2019 WL 690, at *6-9 (holding that actual notice of possible employment claims is not necessarynot necessaryunnecessary; constructive notice is sufficient if is sufficient if is enough if the purchaser has failed to exercise has failed to exercise has not exercised due diligence) discussing Goodpaster, 2019 WL 690, at *3 n. 3; see also Muskowa, 660 F.3d 630 at 666.

b. Contingent and Actual Employment Claims or Violations Will Serve as a Basis as a Basis for Liability

Furthermore, it Furthermore, it It is not necessary not necessary unnecessary for the claim to be in existence be in existence exist at the time that the transaction at the time that the transaction when the transaction closed, knowledge of circumstances that give rise to a potential claim will be sufficientbe sufficientbe enough.

Drago v. Fifth Ave., LLC, 961 F. Supp. 3d at 306-07 citing Abdel-Khalek, 2009 WL 696, at *6 (noting that actual knowledge of circumstances that would lead to a claim, such as knowledge that back pay was owed to former employees, is sufficient notice is sufficient notice is enough notice to trigger successor liability "even where no formal claim or charge had yet been filed").

Courts will impose successor liability on a purchaser who possessed knowledge of possessed knowledge of knew about violations of employment laws, notwithstanding the absence of claims filed prior to prior to before the closing, and irrespective of irrespective of despite misleading representations made by the seller that there were no violations.

See Drago v. Fifth Ave., LLC, 961 F. Supp. 3d at 306.

A formal claim is not required for a purchaser to be said to have notice.

Id. All that is needed is "notice of the charge" or "notice of potential liability."

Id. "At least one federal court has expressly held that a defendant's 'actual knowledge that back pay was owed to former... employees' of the predecessor was sufficient to provide notice of the FLSA claims."

Id. at 306 quoting Brock, 2006 WL 696, at *3.

"[N]otice of the contingent liability when it fully consummated the purchased of substantially all of [seller's] assets and commenced operations" may be sufficient to impose may be sufficient to impose may impose successor liability.

Gumbo v. Wonderly Co., 2019 WL 690, at *13.

c. Mere Knowledge that Certain Laws and Reporting Requirements Exist Does Not Constitute Knowledge

Nevertheless, Nevertheless, Still, in the event that a purchaser in the event that a purchaser if a purchaser lacks information pertaining to pertaining to about federal or state investigations but possesses possesses has a general awareness that employers are obligated to remunerate are obligated to remunerate must remunerate minimum and overtime wages under both federal and state labor laws, and by logical inference, that the seller bears a corresponding obligation obligation duty to fulfill these wage obligations, it cannot be conclusively determined that equity mandates the imposition of successor liability in the absence of in the absence of absent evidence establishing the purchaser's awareness establishing the purchaser's awareness showing the purchaser's awareness of the seller's noncompliance.

Lunas v. Dickerson Supply LLC, 61 F. Supp. 3d at 316.

d. No Notice When Records Do Not Show Potential for Claims or Violations; Notice of One Violation Does Not Mean Notice of All Violations

There may be no constructive notice when the payroll records that seller provided to purchaser do not indicate do not indicate do not show failure to pay certain labor and employment obligations.

Id. at 316 ("None of the payroll records plaintiff submitted indicating that plaintiff may not have received overtime pay are from Ridgewood, and all of them cover periods post-dating Dickerson's purchase of Ridgewood.")

.

Even in cases in cases where the purchaser possesses knowledge of possesses knowledge of knows about allegations and proceeds proceeds moves forward with the asset acquisition, courts do not infer that the purchaser condoned the illicit conduct.

See EEOC v. Nichols Natural, Inc., 699 F. Supp. 3d 193, 303 (W.D.N.L. 2019) ("While it may be true that, prior to closing, Townsend had notice of the allegations against Nichols, which have yet to be proven, the fact that Townsend went ahead with the purchase of Nichols' assets does not mean that Townsend condoned discrimination.")

. And, even if certain violations have been actually found, and the purchaser has notice of the violations, and the purchaser assumes responsibility for those specific conditions created by the seller, courts should not take the leap to imposing liability for all other liabilities, known or unknown.

See Vasquez v. Rainbow Cheese Corp., 2019 WL 692, at *11 ("But, even the assumption of responsibility for some obligations of a predecessor corporation hardly requires that a court infer from an otherwise silent record that it had assumed all existing liabilities and obligations-known and unknown, across the board.")

.

e. Notice Requirement Applied to Marsh

In this instance, In this instance, Marsh's strongest argument lies in the misleading nature of the records received from the seller, which did not show any potential did not show any potential showed no potential violations.

This strongly shows that Marsh did not have notice of these claims.

However, the involvement of a restructuring officer in this sale may cause the court to question the credibility of this assertion.

Additionally, the fact that Additionally, the fact that That IRS had liens on several assets that Marsh purchased purchased bought could have been discovered through additional due diligence, which decreases the likelihood that a court will find a lack of notice.

That saidThat saidHowever, even if some liability is imposed, it is possible to urge the court to impose only certain liabilities but not others.

Establishing knowledge Establishing knowledge Showing knowledge for one type of claim does not automatically infer knowledge for all categories of claims.

In this case, In this case, Here, Marsh did not expressly disclaim labor and employment-related liabilities, but it did negotiate did negotiate negotiated an indemnity clause.

Some courts have found that the presence of the presence of the indemnity clause implies notice and an adequate price adjustment and will justify imposing successor liability upon a purchaser because they assume that "[t]he successor will have been compensated for bearing the liabilities by paying less for the assets it's buying; it will have paid less because the net value of the assets will have been diminished by the associated liabilities."

Thompson v. Real Estate Mortgage Network, 639 F.3d at 161-62.

Furthermore, even Furthermore, even Even if Marsh explicitly disclaimed such liabilities, such disclaimers may not be legally effective.

See Paul Ferdinands, Jeffrey R. Dutson, Successor Liability Under the FLSA, Am. Bankr.

Inst.

J., June 2019, at 13, 69.

("[A] purchaser's express disclaimer of any FLSA liability in an asset-purchase agreement was not a sufficient reason to withhold successor liability.")

.

However, the fact that However, the fact that That Marsh did negotiate did negotiate negotiated an indemnity clause could also be beneficial because some courts are reluctant to impose liability on a purchaser when the purchaser testifies that they did not intend to assume liabilities or historical obligations and there is no evidence suggesting there is no evidence suggesting no evidence suggests the seller's intent to transfer all debts.

Vasquez v. Rainbow Cheese Corp., 2019 WL 692, at *11.

Finally, the fact that Finally, the fact that That Marsh has discovered and corrected the labor and employment violations does not adversely impact adversely impact adversely affect the "substantial continuity" analysis.

Attempting to Attempting to Trying to impose successor liability on an innocent purchaser solely solely only based on transitioning from a violative payroll and wage system to a compliant one is untenable.

See Lunas v. Dickerson Supply LLC, 61 F. Supp. 3d at 316.

Even assuming arguendo, assuming arguendo, if after the completion of the sale, the purchaser modifies modifies changes the previously violative wage scheme of the seller, courts cannot conclude, without additional additional more evidence, that such modification that such modification that such change was driven by the purchaser's awareness of the seller's employment and labor law violations, as opposed to integration into the purchaser's existing wage structure.

Id. (highlighting the absence of the purchaser's knowledge regarding any disparity in the seller's payroll and wage systems prior to prior to before the sale).

V. Insolvency Considerations

Some courts have added a third factor to the "substantial continuity" test.

Courts will consider whether the predecessor company could have paid the liabilities, but the weight of this factor changes depending on fairness principles.

"[T]he extent to which the predecessor is able to provide relief directly" is also relevant.

" Drago v. Fifth Ave., LLC, 961 F. Supp. 3d at 303-05 (citations and quotations omitted); see also Gumbo v. Wonderly Co., 2019 WL 690, at *13 ("Whether [seller] has been rendered insolvent and thus thus cannot provide an adequate . . . is certainly certainly a factor to be considered.")

.

In Muskowa, the Court of Appeals stated that absent extraordinary absent extraordinary without extraordinary circumstances, an injured employee should not be placed in a worse position due to a business change.

Muskowa v. ESSI, Inc., 660 F.3d at 660.

However, this reasoning was subsequently subsequently rejected by the Seventh Circuit, which emphasized the concept concept idea of affording a second chance for recovery as the underlying rationale rationale reasoning for successor liability theories.

See Chicago Teamsters Union (Indep.

) Pension Fund v. Townsend, Inc., 69 F.3d at 61.

And courts in the Third Circuit reject this factor entirelyfactor entirelyfactor: "The notion that successor liability cannot be invoked where it would leave the creditor "better off" is a curious one....To read this factor, or to impose a new one to require a court to look at whether the creditor is better off, seems to undermine the basic rationale underlying the doctrine."

Brzozowski v. Corr.

Physician Servs.

, Inc., 360 F.3d 163, 169 (3d Cir. 2003).

Nevertheless, Nevertheless, Still, the predecessor's ability to pay is significant a factor in the Northern District.

Drago v. Fifth Ave., LLC, 961 F. Supp. 3d at 309 (internal citations and quotations omitted).

Here, the successor clearly clearly could not pay its obligations, so turning to Marsh to satisfy them may be considered inequitable.

However, because these claims are likely to be brought by the government rather than an individual, the outcome may be significantly different.

VI. Balancing Test and Fairness Considerations

Given that Given that Because successor liability is rooted in equitable principles to address gaps in statutes, a flexible and multifaceted approach is appropriate when applying the substantial continuity test.

Valdez v. Celebrity Tours, Inc., 931 F. Supp. 3d at 933-34 (citations omitted).

Therefore, once Therefore, once So, once a court determines that the substantial continuity test warrants warrants justifies the imposition of successor liability, a subsequent balancing test must be conducted to evaluate the fairness and equity of such impositionsuch impositionthis imposition.

The successor doctrine is based on equitable principles, and it would be unjust, except in exceptional circumstances, to impose liability on an innocent purchaser who had no who had no with no opportunity to protect itself through indemnification or a lower purchase price.

Lunas v. Dickerson Supply LLC, 61 F. Supp. 3d at 313-15 (internal citations and quotations omitted).

In this context, courts consider "1) the defendant's interest, 3) the plaintiff's interest, and 3) federal policy embodied in the relevant statutes in light of the particular facts of the case and the particular duty at issue."

Corn v. Fast Transp.

, Inc., 361 F.3d at 661-62 citing EEOC v. MacMillan Bloedel Containers, Inc., 603 F.3d 1096, 1096-97 (15th Cir. 1963).

Some courts return to the MacMillan Bloedel factors and apply them as part of the balancing test.

VII. Burden of Proof

The burden lies with the party advocating for successor liability to demonstrate that demonstrate that show the purchaser had prior notice of potential FLSA and other labor and employment claims prior to prior to before purchasing purchasing buying the assets.

See Lunas v. Dickerson Supply LLC, 61 F. Supp. 3d at 314-15; see also Malfoy v. Thai Cooking, Inc., 2019 WL 690, at *6-7 citing Cell Phone Technologies, Inc. v. Garrund Travel Pub. Corp., 636 F.3d 39, 61 (3d Cir. 2019); Milli v. Pressing Corp., No. 90-cv-3339, 2003 WL 696, at *6 (S.D.N.L. June 9, 2003); see also Heights v. U.S. Elec. Tool Co., 616 N.L.S.3d 663, 139 A.D.3d 369 (3d Dep't 2009); Vasquez v. Rainbow Cheese Corp., 2019 WL 692, at *10.

To state a plausible claim for successor liability, plaintiffs must plead factual allegations that enable the court to evaluate the following elementsthe following elementsthese elements: (1) the presence of substantial continuity in the business operations between the successor and predecessor; (2) the successor's awareness of potential liability at the time of asset acquisition; (3) the predecessor's ability to provide direct relief; and (4) the equitable considerations supporting the imposition of successor liability.

Valdez v. Celebrity Tours, Inc., 931 F. Supp. 3d at 933.

Part II: Specific Claims and Limitation on Damages

I. FLSA Claims

Successor liability was originally adopted in cases brought under the NLRA "to avoid labor unrest and provide some protection for employees against the effects of a sudden change in the employment relationship." Drago v. Fifth Ave., LLC, 961 F. Supp. 3d at 303 quoting Staunch, 61 F.3d at 936. "[J]udicial importation of the concept of successor liability is essential to avoid undercutting Congressional purpose by parsimony in provision of effective remedies." Wheeler v. Snyder, Inc., 693 F.3d at 1336.

Public policy strongly favors imposing liability on a purchaser of assets when FLSA claims are present.

"'FLSA was passed to protect workers' standards of living through the regulation of working conditions,' and concluded that '[t]hat fundamental purpose is as fully deserving of protection as the labor peace, anti-discrimination, and worker security policies underlying the NLRA, Title VII, 33 U.S.C. § 2001, ERISA, and MPPAA.' ... [T]he Fifteenth Circuit 'has observed that the FLSA has a 'remedial' purpose, and that 'Congress intended the statute to have the widest possible impact in the national economy.'" Drago v. Fifth Ave., LLC, 961 F. Supp. 3d at 303-04 (citations omitted).

With regard to With regard to Regarding FLSA claims, "knowledge of the failure to pay alone is sufficient to put a successor on notice of potential liability."

Id. at 306-07.

II. FICA and FUTA Taxes

The IRS has started an early interaction initiative targeted at employers who appear to be falling appear to be falling appear to fall behind on employment tax payments.

The service is specifically looking for employers who serially fail to pay employment taxes and continually open new companies and paying close attention to companies that use professional employer organizations ("PEO").

Because HRD failed to failed to did not pay its employment taxes and both HRD and Marsh utilized utilized used a PEO, it is likely that the IRS will likely investigate it is likely that the IRS will likely investigate the IRS will likely likely investigate HRD, which will lead to Marsh.

If HRD is responsible, then it is likely that Marsh will be it is likely that Marsh will be Marsh will likely be responsible as well.

Gilman Photo, Ltd. v. C.I.R., 133 T.C. 96, 109 (2019) citing Raynd Co. v. Commissioner, 613 F.3d 960, 961 (3d Cir. 2000) ("The Government may rely on the successor liability doctrine to hold a successor corporation liable for the tax debts of its predecessor.")

. However, it is important to note However, it is important to note However, note that the IRS is not constrained to federal common law successor liability theories to reach Marsh, employment taxes may be collected against "a successor who received assets from a taxpayer who owed the taxes" on theories of "transferee liability against [purchaser] under section 6901 by issuing Notices of Determination Concerning Worker Classification[;]" and targeting the purchaser's principal as a "responsible person...under section 6663[,]" not just state or federal common law theories of successor liability.

Gilman Photo, Ltd. v. C.I.R., 133 T.C. at 111-13.

III. Form W-9 Violations

In addition to FICA and FUTA taxes, the government has additional additional more theories available to it to hold Marsh responsible.

Employers are required to maintain are required to maintain must maintain Form W-9s and E-Verify employment verification records documenting their employee's identification and authorization authorization permission to work in the United States.

Successors have the option of assuming Successors have the option of assuming Successors may assume the prior employer's Form W-9s.

Failure to comply with comply with follow Form W-9 requirements may result in serious sanctions running in to the thousands of dollars per employee and a number of a number of several new state immigration laws tie various sanctions, including the loss of a business license.

It should be noted that employment-immigration It should be noted that employment-immigration Employment-immigration related issues are more complex because some employees may be relying on proper immigration status may be relying on proper immigration status may rely on proper immigration status and need Marsh to take responsibility as a successor, however, this may expose Marsh to additional additional more liabilities.

It is unclear whether Marsh could be a successor in interest for the purposes of maintaining for the purposes of maintaining to maintain certain immigration records, but not a successor for the purpose of avoiding for the purpose of avoiding to avoid the Form W-9 violations.

IV. Limitation on Damages

In the event that Marsh In the event that Marsh If Marsh is unable to is unable to cannot absolve itself from successor liability, it may still avail itself of certain limitations.

From an equitable standpoint, it is justifiable to impose the original full full amount required to fully fully remedy the harm suffered by employees; however, it would be unjust to impose pre-judgment interest, punitive fines, and damages.

See Ranch v. Old County, Inc., 966 F. Supp. 3d at 399 (vacated on other grounds) distinguishing Nichols Natural, 699 F. Supp. 3d at 303-05.

It has been recognized that It has been recognized that Some have recognized that punitive damages serve the purpose of penalizing serve the purpose of penalizing penalize the wrongdoer and are not suitable for imposition upon an innocent successor.