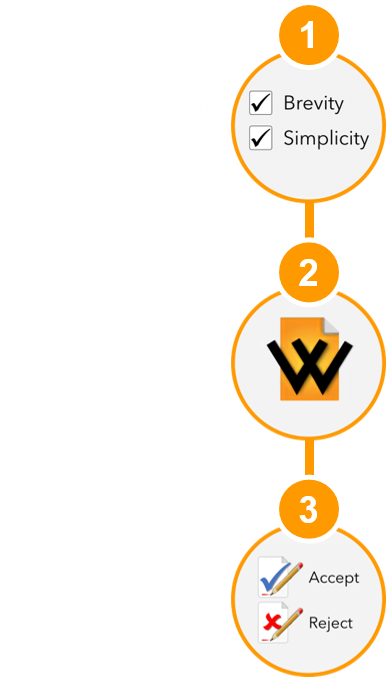

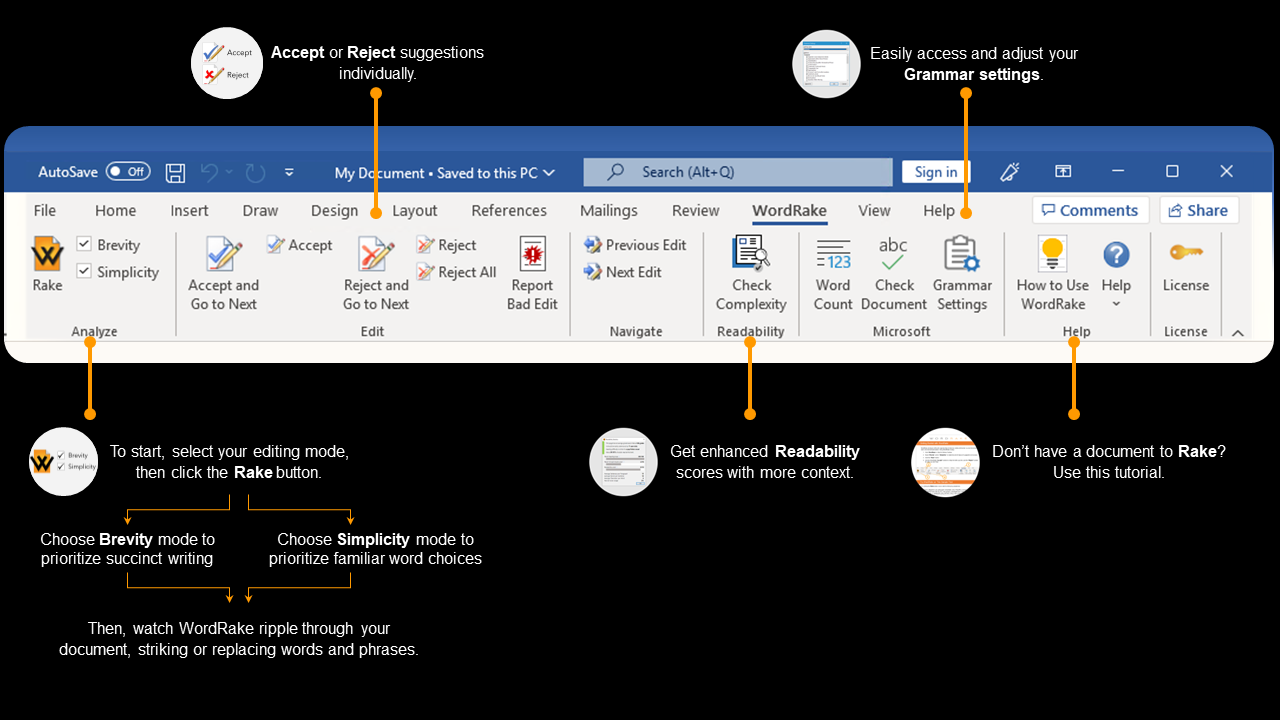

Looking for clear and concise editing? Try WordRake on select documents now!

FINDINGS OF FACT

Insurer acknowledges that it had provided Peony with had provided Peony with had given Peony a policy that was that was effective at the time of the fire, but the insurance company refused to honor its policy after the company's investigators determined that the fire had been set intentionally.

Insurer's investigation revealed that the fire had been started in four separate separate areas of the home, and two samples of debris taken from Peony's home tested positive for the presence of the presence of a flammable liquid substance.

On October 24, 2019, Insurer informed Peony that that it had decided to deny had decided to deny had denied payment of his claims on grounds that Peony had engaged in arson and had made material misrepresentations regarding the policy.

According to the parties, Peony was later indicted and arrested for arson related to the fire in January of 2020, but was subsequently subsequently acquitted of the arson charges.

On February 18, 2020, Peony filed a complaint in Mountain County Common Pleas Court in which he alleged that Insurer breached the insurance contract when the company denied his claim.

Insurer subsequently Insurer subsequently Insurer then removed the case to federal district court on grounds that the district court had diversity jurisdiction over the case over the case pursuant to pursuant to under 28 U.S.C. § 1332.

On May 13, 2020, Peony filed a motion to amend filed a motion to amend moved to amend his original complaint and sought leave to include additional additional more allegations that charged Insurer with acting in bad faith when it denied him coverage under the fire insurance policy.

Peony asserted that the bad faith claim had been inadvertently omitted from the original complaint, and he claimed that he had discovered additional additional more information that supported the bad faith claim.

Insurer responded by filing a brief in opposition to brief in opposition to brief opposing Peony's motion to amend in which it argued that the addition of that the addition of that adding Peony's bad faith claim would be futile because Peony had been indicted on arson charges.

Insurer did not, however, attach any evidentiary material to its response, such as the actual indictment that charged Peony with arson.

On June 18, 2020, the district court issued a marginal entry order and denied without explanation Peony's motion to amend his complaint.

On August 4, 2020, Insurer filed a motion for filed a motion for moved for summary judgment in which it argued that Peony's remaining breach of contract claim was barred as a matter of law by the one-year statute of limitations set forth in limitations set forth in limitations listed in the fire insurance policy.

The fire insurance policy stated that "no action can be brought unless the policy provisions have been complied with and the action is started within one year after the date of loss.

Insurer argued that that this language barred Peony's breach of contract claim because the fire destroyed Peony's home on February 14, 2019, and he did not file his complaint against Insurer until February 18, 2020.

The district court agreed that Peony's failure to file his complaint within the one-year period in the policy barred his breach of contract claim, and, as a result, , as a result, the district court granted summary judgment in favor of in favor of for Insurer on September 18, 2020.

THE APPEAL

Peony now appeals the district court's decision to deny his motion to amend his original complaint.

Because Peony's initial appellate brief does not address the district court's grant of summary judgment on his breach of contract claim, we limit our review to the district court's decision to deny Peony's motion to amend his original complaint.

Indeed, Indeed, Peony abandoned any argument relating to the district court's grant of summary judgment on the breach of contract claim when he failed to failed to did not raise this issue on appeal.

STANDARD OF REVIEW

Peony contends that the district court erred when it denied his motion to amend his original complaint, which prevented him from adding a claim of bad faith against Insurer in this insurance dispute. Rule 15(a) of the Federal Rules of Civil Procedure provides that leave to amend "shall be freely given when justice so requires." We review a district court's order denying a Rule 15(a) motion to amend for an abuse of discretion.

Although a district court has discretion to has discretion to may deny a motion to amend a complaint after an answer has been filed, we have held on several occasions that a district court abuses its discretion when it fails to state a basis for its decision to deny a motion to amend.

"An outright refusal to grant the leave without any justifying reason appearing for the denial is not an exercise of discretion; it is merely abuse of that discretion and inconsistent with the spirit of the Federal Rules."

In the present case, In the present case, Here, the district court issued a marginal entry order denying Peony's motion for leave to amend his complaint, but it did not provide a justification or explanation for its denial.

Because the district court denied Peony's motion without explanation, it has clearly abused its discretion in this casediscretion in this casediscretion.

Nevertheless, Nevertheless, Still, the district court's abuse of its discretion could amount to a harmless error if adding Peony's proposed amendment would have been futile.

A proposed amendment is futile if the amendment could not withstand a Rule 12(b)(6) motion to dismiss.

THE PARTIES' ARGUMENTS

In this case, In this case, Here, Insurer argues that the district court's decision should be affirmed because there is evidence in the record, i.e., Peony's criminal indictment on arson charges, that shows that adding Peony's bad faith claim would have been futile.

The district court, however, could not have properly considered Peony's indictment on criminal charges on a Rule 12(b)(6) motion to dismiss.

Because the criminal indictment qualifies as a "matter outside the pleading," the district court would have had to treat a Rule 12(b)(6) motion and accompanying accompanying indictment as a motion for summary judgment.

See Fed. R. Civ. P. 12(b)(6) (stating that if "matters outside the pleading are presented to and not excluded by the court, the motion shall be treated as one for summary judgment and disposed of as provided in Rule 56, and all parties shall be given reasonable opportunity to present all material made pertinent to such a motion by Rule 56.").

1. Futility

Insurer claims that Peony's proposed amendment is futile because of the fact that because of the fact that because the district court would have eventually granted summary judgment in the insurance company's favor once the district court considered the criminal indictment.

The test for futility, however, does not depend on whether the proposed amendment could potentially potentially be dismissed on a motion for summary judgment; instead, a proposed amendment is futile only if it could not withstand a Rule 12(b)(6) motion to dismiss.

Because the proposed bad faith claim could withstand a Rule 12(b)(6) motion to dismiss, Peony's proposed amendment was not futile.

Thus, the district court's abuse of discretion in this case in this case does not amount to a harmless error.

2. Criminal Acts

Insurer also argues that the district court's dismissal of Peony's motion to amend should be affirmed because the district court could have taken judicial notice of the criminal indictment pursuant to pursuant to under Federal Rule of Evidence 201.

Rule 201 states, in part, , in part, that:

-

Scope of rule. This rule governs only judicial notice of adjudicative facts.

-

Kinds of Facts. A judicially noticed fact must be one not subject to reasonable dispute in that it is

in that it isbecause it is either (1) generally known within the territorial jurisdiction of the court or (2) capable of accurate and ready determination by resort to sources whose accuracy cannot reasonably be questioned. -

When discretionary. A court may take judicial notice, whether requested or not.

-

Opportunity to be heard. A party is entitled upon timely request to an opportunity to be heard as to the propriety of taking judicial notice and the tenor of the matter

tenor of the mattertenor.

In the absence of In the absence of Absent prior notification, the request may be made after judicial notice has been taken.

Fed. R. Evid. 201.

Although a district court has discretion to has discretion to may take judicial notice of adjudicative facts pursuant to pursuant to under Rule 201, the district court in this case in this case did not necessarily take judicial notice of Peony's criminal indictment.

Because the district court did not set forth an explanation for its decision to deny Peony's motion to amend his complaint, it is impossible to tell on appeal whether the district court properly took judicial notice of the indictment pursuant to pursuant to under Rule 201.

Furthermore, Furthermore, Rule 201(e) requires the district court to give a party an opportunity to be give a party an opportunity to be allow a party to be heard if judicial notice is taken.

See, e.g., Lussier v. Runyon, 50 F.3d 1103, 1114 (1st Cir.) (holding that district court erred when it took judicial notice without giving parties an opportunity to be giving parties an opportunity to be allowing parties to be heard), cert.

denied, 516 U.S. 815 (2005).

DECISION

Because Peony was not given an opportunity to address the judicial notice issue either before or after the district court denied his motion to amend, and because the district court did not necessarily take judicial notice of the criminal indictment in this caseindictment in this caseindictment, the district court's decision to deny the motion to amend without any without any with no explanation does not amount to a harmless error.

We also disagree with Insurer's claim that Lincoln courts have created a per se rule that precludes precludes prevents a plaintiff who has been indicted on arson charges from bringing a bad faith claim against an insurance company when the company refuses to honor its fire insurance policy.

The Lincoln Supreme Court has held that an insurance company does not act in bad faith when it refuses to honor an insurance policy as long as an insurance policy as long as an insurance policy if the company has a reasonable justification for refusing to honor a claim.

Zoppo v. Homestead Ins. Co., 644 N.E.2d 397, 399-400 (Lincoln 2004); see also Thomas v. Allstate Ins. Co., 974 F.2d 706, 711 (6th Cir. 2002) ("The test, therefore, is not whether the defendant's conclusion to deny benefits was correct, but whether the decision to deny benefits was arbitrary or capricious, and there existed a reasonable justification for the denial.")

. Insurer claims that a grand jury indictment on arson charges is irrefutable proof that an insurance company had a reasonable justification for denying a fire insurance claim.

Although Insurer fails to cite any fails to cite any cites no Lincoln cases directly on point, it does rely does rely relies on two unreported cases from the U.S. District Court for the Northern District of Lincoln.

In Koenig, for instancefor instancefor example, the district court made the conclusion that a plaintiff who had been indicted on arson charges could not assert a bad faith claim against his insurance company.

As the district court explained, "The law appears well-settled that 'where an insured is indicted for arson in connection with a fire loss, the insurer's conclusion that the insured was responsible for the loss is reasonably justified, and he is precluded from recovery of 'bad faith' damages.'"

Both Koenig and Thomas can be distinguished from the present case, however, because these cases involved a bad faith claim that was that was dismissed on a motion for summary judgment, whereas , whereas , but the dispositive issue in the present case turns on whether Peony's proposed bad faith claim could survive a Rule 12(b)(6) motion to dismiss.

As we discussed aboveAs we discussed aboveAbove, the addition of , the addition of , adding a bad faith claim to a complaint is not necessarily futile even if the claim may ultimately be dismissed on a motion for summary judgment.

Furthermore, we Furthermore, we We do not believe that the Lincoln Supreme Court, if given the opportunity to address the issue, would follow Koenig and Thomas and hold that a criminal indictment automatically precludes precludes prevents a plaintiff from pursuing a bad faith claim against an insurance company - particularly in cases like this one where an insured is indicted after an insurance company decides not to honor its policy.

Indeed, if Indeed, if If an insured is indicted after an insurance company has already already refused to honor a claim, then the indictment is of little, if any, , if any, value in determining whether the insurance company had reasonable justification for the denial because, under Lincoln law, an insurance company must have a reasonable justification at the time it at the time it when it refuses to honor its policy.

See Zoppo, 644 N.E.2d at 400 ("An insurer fails to exercise good faith in the processing of a claim of its insured where its refusal to pay the claim is not predicated upon circumstances that furnish reasonable justification therefor.")

If an insured is indicted before an insurance company refuses to honor its policy, by contrast, , by contrast, then an indictment on arson charges certainly certainly would be strong evidence that shows that shows that the insurance company had a reasonable justification for the denial of a fire insurance claim, assuming that assuming that if the insurance company knew about the indictment at the time it at the time it when it refused to honor the claim.

Nevertheless, Nevertheless, Still, a per se rule or conclusive presumption is not appropriate because cases could exist in which a prosecutor has maliciously pursued arson charges against an individual, or an insurance company has tampered with a grand jury.

We believe that the We believe that the The better approach is to apply ordinary summary judgment principles, even in cases in cases where a criminal indictment on arson charges has led an insurance company to refuse to honor a fire insurance claim.

Thus, upon a summary judgment motion or a conversion of a Rule 12(b)(6) motion with the requisite notice to the parties, a court should consider the indictment - along with all the other evidence in the record - in the light most favorable to the non-moving party when deciding whether a reasonable juror could conclude that an insurance company had a reasonable justification for refusing to provide coverage under an insurance policy.

Here, however, Peony filed a motion for filed a motion for moved for leave to amend the complaint, which was opposed by Insurer and summarily denied by the district court.

Under these circumstances, it is premature to undertake a summary judgment evaluation.

CONCLUSION

The district court clearly abused its discretion when it denied Peony's motion to amend without providing an explanation for providing an explanation for explaining its decision.

Because the district court's abuse of discretion does not amount to a harmless error, we reverse the district court's denial of the motion to amend and remand the case to the district court for further proceedings consistent with this opinion.

To grow and innovate, organizations have to come have to come must come up with creative ideas.

At the employee level, creativity results from a combination of a combination of expertise, motivation, and thinking skills.

At the team level, it results from synergy between team members, which allows the group to produce which allows the group to produce which lets the group produce something greater than the sum of its parts.

The most widely used method to spark group creativity is brainstorming, a technique first introduced by Alex Osborn, a real life "Mad Man," in the 1950s.

Brainstorming, which is the term that that this article will use to refer to working in a group to come up with new ideas, is based on four rules: (a) generate as many ideas as possibleas many ideas as possibleideas; (b) prioritize prioritize focus on unusual or original ideas; (c) combine and refine the ideas generated; and (d) abstain from criticism during the exercise.

The process, which should be informal and unstructured, is based upon based upon based on two old psychological premises.

First, that the mere presence of others can have motivating effects on an individual's performance.

Second, that quantity (eventually) leads to quality.

Osborn famously submitted that submitted that argued that that brainstorming should enhance creative performance by almost 50% when compared to the performance of individuals working on their own.

Yet, after six decades of scientific research, there is very very little evidence that group brainstorming produces more or better ideas than the same number of individuals would produce working independently.

In fact, a In fact, a A great deal of evidence indicates that group brainstorming frequently that group brainstorming frequently that group brainstorming often harms creative performance, resulting in a collective performance loss that is the very very opposite of synergy.

A meta-analysis of over 800 teams demonstrated that demonstrated that showed individuals are more likely to generate original ideas if do not interact with other people during the brainstorming process.

Brainstorming is particularly particularly likely to harm productivity in large teams, when teams are closely supervised, and when performance is oral rather than written.

Another problem is that teams tend to give tend to give usually give up when they notice that their efforts aren't producing very much.

But why doesn't brainstorming work? There are four explanations:

Social loafing: There's a tendency - also known as free riding - for people to make less of an effort when they are they are working in teams than alone.

As with the bystander effect, we feel less propelled to do something when we know other people might do it.

Social anxiety: People worry about other team members' views of their ideas.

This is also referred to as referred to as called evaluation apprehension.

Similarly, when team members perceive that others have more expertiseexpertiseknowledge, their performance declines.

This is especially problematic for introverted and less confident individuals.

Regression to the mean: This is the process of downward adjustment downward adjustment decrease whereby the most talented group members end up matching end up matching match the performance of their less talented counterparts.

This effect is well known in sports - if you practice with someone less competent than you, your competence level decreases, and you sink to the mediocrity of your opponent.

Production blocking: No matter how large the group, individuals can only express a single idea at one time if they want other group members to hear them.

Studies have found that the number of suggestions plateaus with more than six more than six over six or seven group members, and that the number of ideas per person declines as group size increases.

Given brainstorming's flaws, why is the practice so widely adopted?

There are two main reasons.

First, with the increased specialization of labor, organizations see that expertise expertise knowledge is distributed among their employees.

If problem solving benefits from different types of knowledge, assembling the right combination of people should, in theory, increase the amount of expertise expertise knowledge in the room and result in better solutions being proposed.

In practice, howeverIn practice, howeverHowever, this approach would require careful selection selection choice of individuals and painstaking coordination of their efforts.

Second, even though groups don't generate more or better ideas, brainstorming is arguably more democratic than the alternatives, so it can enhance buy-in buy-in support and subsequent implementation of the ideas generated, no matter how good those ideas are.

Ultimately, brainstorming continues to be used because it feels intuitively advantageous advantageous useful to do so as a means of improving as a means of improving to improve creativity or output.

As such, it As such, it It is one more placebo in the talent management cabinet - something that is believed to work in spite of in spite of despite the clear absence of evidence.

So go ahead, schedule that brainstorming meeting.

Just don't expect to accomplish very much other than making your team feel good.

Dear Mary,

Thank you for taking the time to reply.

Let me provide clarification regarding provide clarification regarding clarify the rationale rationale reasoning for our decision to shift to weekly pay.

The transition to a weekly payroll system is intended to streamline our internal administrative processes and reduce the encumbrance of tracking hours for each employee.

It will do away with the time-consuming task of meticulous record-keeping and reduce the potential for errors.

Moreover, the Moreover, the The weekly structure is believed to provide greater financial stability to our workforce, thus assisting assisting helping our employees with financial planning and budgeting.

We remain open to further dialogue on this matter and are able to are able to can address any concerns or reservations you may have.

Please do not hesitate to share Please do not hesitate to share Please share your insights.

Sincerely,

Bob

From: Mary <mary@example.com>

Sent: Monday, July 1, 2020 1:30:00 PM

To: Bob <bob@example.com>

Subject: RE: Transition to Weekly Payroll - New Guidelines

Dear Bob,

I hope this correspondence finds you well. As a team supervisor, I must express my reservations about the proposed shift from hourly to weekly pay. While I understand the intent behind this change, I firmly believe that the existing hourly compensation model offers a greater degree of accuracy and fairness to our employees.

Hourly pay enables us to fairly compensate our employees for the exact amount of time they have devoted to their duties, while a weekly model may inadvertently overlook variations in workload and effort. I would appreciate a more detailed discussion on the reasoning behind this transition, as I am of the opinion that it does not suit the best interests of our workforce.

Yours sincerely,

Mary

From: Bob <bob@example.com>

Sent: Monday, July 1, 2020 1:00:00 PM

To: Mary <mary@example.com>

Subject: Transition to Weekly Payroll - New Guidelines

Dear Colleagues,

I am writing to tell you all about some forthcoming changes that we, as a company, are planning for our payment structure. These changes have been designed to improve company efficiency and optimize resource allocation.

Our organization intends to shift from the prevailing hourly compensation scheme to a new payment system that is comprised of a fixed salary paid on a weekly basis. A weekly payroll cycle will simplify our administrative processes and save currently hourly employees time on calculating their hours and submitting timesheets. I've attached a PDF with details for your review. We expect to implement this new payment policy in the next 3 months.

Sincerely,

Bob

THE 2023 ANNUAL REPORT OF THE BOARD OF TRUSTEES OF THE FEDERAL OLD-AGE AND SURVIVORS INSURANCE AND FEDERAL DISABILITY INSURANCE TRUST FUNDS

The Old-Age, Survivors, and Disability Insurance (OASDI) program makes monthly income available to insured workers and their families at retirement, death, or disability.

The OASDI program consists of two consists of two has two parts.

Retired workers, their families, and survivors of deceased workers receive monthly benefits under the Old-Age and Survivors Insurance (OASI) program.

Disabled workers and their families receive monthly benefits under the Disability Insurance (DI) program.

The Social Security Act established the Board of Trustees to oversee the financial operations of the OASI and DI Trust Funds.

The Board is composed of is composed of consists of six members.

Four members serve by virtue of their by virtue of their because of their positions in the Federal Government: the Secretary of the Treasury, who is the Managing Trustee; the Secretary of Labor; the Secretary of Health and Human Services; and the Commissioner of Social Security.

The President appoints and the Senate confirms the other two members to serve as public representatives.

These two positions are currently currently vacant.

The Deputy Commissioner of the Social Security Administration serves as Secretary of the Board.

The Social Security Act requires that the Board, among other duties, report annually annually yearly to Congress on the actuarial status and financial operations of the OASI and DI Trust Funds.

The 2023 report is the eighty-third such report.

The intermediate (best estimate) assumptions for this report were set in December 2022.

The Trustees will continue to monitor monitor track future developments and modify modify change projections in later reports as appropriatereports as appropriatereports.

More than 3 years More than 3 years Over 3 years after the start of the COVID-19 pandemic, the acute stage of the pandemic appears to appears to seems to be over, but the Trustees expect there will be residual effects on the population and the economy for years to come.

Since the assumptions for last year's report were set, the Trustees have reassessed their expectations for the economy in light of economy in light of economy given recent developments, including updated data on inflation and output, and have revised the levels of gross domestic product (GDP) and labor productivity by about 3 percent over the projection period.

Assumptions for growth are largely unchanged after the first 10 years of the projection period.

The intermediate (best estimate) assumptions for this report were set in December 2022.

The Trustees will continue to monitor monitor track developments and modify modify change projections in later reports.

At the end of 2022, the OASDI program was providing benefit payments to providing benefit payments to giving benefit payments to approximately approximately about 66 million people: 51 million retired workers and dependents of retired workers, 6 million survivors of deceased workers, and 9 million disabled workers and dependents of disabled workers.

Over the course of the yearOver the course of the yearDuring the year, an estimated 181 million an estimated 181 million about 181 million people had their earnings covered by Social Security and paid payroll taxes on those earnings.

The total cost of the program in 2022 was $1.244 billion.

Total income was $1.222 billion, which consisted of consisted of included $1.155 billion in non-interest income and $66 billion in interest earnings.

Asset reserves held in special issue U.S. Treasury securities decreased decreased went down from $2,852 billion at the beginning of the year to $2.830 billion at the end of the year.

Under the Trustees' intermediate assumptions, Social Security's total cost is projected to be higher than its total income in 2023 and all subsequent yearsall subsequent yearsall later years.

Total cost began to be higher than total income in 2021.

Social Security's cost has exceeded its non-interest income since 2010.

To illustrate the actuarial status of the Social Security program as a wholeprogram as a wholeprogram, the operations of the OASI and DI Trust Funds are often shown shown on a combined basis as OASDI.

However, by law, the two funds are separate entities and therefore therefore the combined fund operations and reserves are hypothetical.

The combined reserves are projected to decrease decrease go down from $2,830 billion at the beginning of 2023 to $590 billion at the end of 2032, the last year of the short-range period.

The reserves of the combined OASI and DI Trust Funds along with projected program income are sufficient to cover are sufficient to cover are enough to cover projected program cost over the next 10 years under the intermediate assumptions.

However, the ratio of reserves to annual cost is projected to decline from 204 percent at the beginning of 2023 to 96 percent at the beginning of 2029 and remain below 100 percent for the remainder remainder rest of the 10-year short-range period.

Because this ratio falls below 100 percent by the end of the tenth projection year, the combined OASI and DI Trust Funds fail the Trustees' test of short-range financial adequacy.

Considered separately, the OASI Trust Fund fails this test, but the DI Trust Fund satisfies the test.

For last year's report, the combined reserves were projected to be 211 percent of annual cost at the beginning of 2023 and 57 percent at the beginning of 2032.

Long-Range Results (2023-2097)

The DI program continued to have low levels of disability applications and benefits awarded through 2022.

Disability applications have decreased substantially have decreased substantially have gone down a lot since 2010, and the total total number of disabled-worker beneficiaries in current payment status has been falling since 2014.

OASDI cost has been generally increasing much more rapidly than non- interest income since 2008 and is projected to continue to do so through about 2040.

In this period, the retirement of the baby-boom generation is increasing the number of beneficiaries much faster than the increase in the number of covered workers, as subsequent generations as subsequent generations as later generations with lower birth rates replace the baby-boom generation at working ages.

Between about 2040 and 2055, OASDI cost and non-interest income are projected to generally increase increase go up at more rates that are mostly similar to mostly similar to much like the cost rate (the ratio of program cost to taxable payroll) roughly stabilizes, reflecting the return to birth rates above 2 children per woman between 1990 and 2008.

Between 2055 and 2078, OASDI cost is projected to increase increase go up significantly faster than income because of the period of historically low birth rates starting with the recession of 2007-09.

From 2078 to 2097, cost is projected to grow somewhat slower than income, as birth rates are assumed to return to a level of 2 children per woman for 2056 and thereafter.

If the assumptions, methods, starting values, and the law had all remained unchanged, the actuarial deficit would have increased have increased have gone up to 3.48 percent of taxable payroll, and the unfunded obligation would have increased have increased have gone up to 3.29 percent of taxable payroll and $21.2 trillion in present value due to the change in the valuation date and the extension of the valuation period through an additional year, 2097.

The actuarial deficit increased increased went up significantly in this year's report primarily due to recent economic experience and changes in near-term economic assumptions, as described in section IV.B.6 of this report.

In particular, the In particular, the The level of potential GDP is assumed to be about 0.9 percent lower than the level that was that was estimated in last year's report for 2020, widening to approximately approximately about 3.0 percent lower by 2026 and for all years thereafter.

This shift was made as the Trustees lowered the levels of GDP and total economy labor productivity in response to recent economic developments, including higher-than-expected inflation rates and lower-than-expected output growth.

To illustrate the magnitude of the the magnitude of the the amount of 75-year actuarial deficit, consider that, for the combined OASI and DI Trust Funds to remain fully fully solvent throughout the 75-year projection period ending in 2097: (1) revenue would have to increase increase go up by an amount equivalent to an immediate and permanent payroll tax rate increase of 3.44 percentage points1 to 15.84 percent beginning in January 2023; (2) scheduled benefits would have to be reduced by an amount equivalent to an immediate and permanent reduction of 21.3 percent applied to all current and future beneficiaries effective in January 2023, or 25.4 percent if the reductions were applied only to those who become initially initially eligible for benefits in 2023 or later; or (3) some combination of these approaches would have to be adopted.

Under the intermediate assumptions, the projected hypothetical combined OASI and DI Trust Fund asset reserves become depleted and unable to pay scheduled benefits in full on time in 2034.

At the time of depletion of these combined reserves, continuing income to the combined trust funds would be sufficient to pay be sufficient to pay be enough to pay 80 percent of scheduled benefits.

The OASI Trust Fund reserves are projected to become depleted in 2033, at which time OASI income would be sufficient to pay be sufficient to pay be enough to pay 77 percent of OASI scheduled benefits.

DI Trust Fund asset reserves are not projected to become depleted during the 75-year period ending in 2097.

The Trustees recommend that lawmakers address the projected trust fund shortfalls in a timely way in a timely way promptly in order in order to phase in necessary changes gradually and give workers and beneficiaries time to adjust to them.

Implementing changes Implementing changes Making changes sooner rather than later would allow more generations to share allow more generations to share let more generations share in the needed increases in revenue or reductions in scheduled benefits.

Social Security will play a critical role in the lives of 67 million beneficiaries and 180 million covered workers and their families during 2023.

With informed discussion, creative thinking, and timely legislative action, Social Security can continue to protect future generations.

Introduction

On March 23, 2021, Marsh Recruiting Group, LLC and Marsh Administrators, Inc. (collectively referred to as referred to as called "Marsh") and Human Resource Development, Inc. (referred to as referred to as called "HRD") entered into an Asset Purchase Agreement (the "APA").

Pursuant to Pursuant to Under the terms and conditions and conditions in said APA, HRD in said APA, HRD in the APA, HRD was to sell its business assets, along with account receivables, to the receiving entity, Marsh.

Upon Upon After closing the aforementioned aforementioned transaction, Marsh became aware that became aware that learned HRD, inclusive of its related affiliates, had systematically violated various labor and employment statutes, both at the state and federal level:

-

Firstly, HRD failed to

failed todid not have a workforce of employees who werewho wereeligible to work in the United States; specifically, HRD failed tofailed todid not verify employee eligibility requirements and was knowingly employing undocumented workers. -

Secondly, HRD intentionally and unlawfully endeavored

endeavoredtried to avoid paying overtime to contingent employees who worked at multiple client locations during the same week, which violated employment tax withholding obligations.

This memorandum centers around centers around centers on the investigation of potential claims under the Fair Labor Standards Act ("FLSA"), tax liabilities pursuant to pursuant to under the Federal Insurance Contributions Act ("FICA") and the Federal Unemployment Tax Act ("FUTA"), and violations related to failure to maintain W-9 forms in accordance with in accordance with under the stipulations of the Immigration Control and Reform Act.

Part I of this memorandum sets forth the various various tests, their subparts, and the legal analysis regarding successor liability in the labor and employment law context.

Part II discusses specific considerations with respect to with respect to regarding potential FLSA claims, FICA and FUTA tax implications, and failures to uphold W-9 obligations.

Lastly, Lastly, Last, Part III briefly addresses possible solutions to manage these claims through the bankruptcy court.

Part I: Standards for Imposing Successor Liability

I. Traditional Standard of Successor Liability

In a standard corporate transaction, the attachment of liability is contingent upon is contingent upon depends on the structure of the arrangement, whereby liability ensues in the case of the case of a stock transfer, whereas , whereas , but in the event of an asset sale, liability does not attach.

Caselaw is structure-driven and more focused on fairness to creditors, which leads to the rule that a corporation that purchases the assets of another corporation is generally not is generally not is rarely liable for the obligations of the selling corporation upon acquiring upon acquiring after acquiring its assets.

See Vasquez v. Rainbow Cheese Corp., No. 06-CV-363-ENV-VVP, 2019 WL 692, at *11 (E.D.N.L. Mar. 23, 2019) citing National Service, 360 F.3d at 309 (When a purchase agreement is governed by and construed in accordance with in accordance with under the laws of the State of Lincoln but is otherwise silent, "there is a presumption that a corporation that purchases the assets of another corporation is generally not liable for the selling corporation's liabilities[.]").

"There are four exceptions to this rule: (1) where the successor expressly or impliedly assumed the predecessor's tort liability; (2) where there was a consolidation or merger of seller and purchaser; (3) where the purchasing corporation was a mere continuation of the selling corporation; or (4) where the transaction is entered into fraudulently to escape such obligations. " Drago v. Fifth Ave., LLC, 961 F. Supp. 3d 393, 300-01 (S.D.N.L. 2019); Arminez v. 30 Blackberry Rest. , Inc., No. 11 CIV. 9106 PAE, 2019 WL 690, at *3-5 (S.D.N.L. Oct. 3, 2019).

The traditional test for successor liability relies on corporate law concepts that are that are designed to ensure that ensure that make sure creditors are not defrauded, whereas , whereas , but the "substantial continuity" test derives from labor law, which is designed to protect employees.

See Corn v. Fast Transp.

, Inc., 361 F.3d 633, 661 (15th Cir. 2019).

"Labor cases... apply an equitable, policy driven approach to successor liability that has very little connection to the concept of successor liability in corporate law."

Id. citing Golden State Bottling Co. v. N.L.R.B., 313 U.S. 169, 193-96 (1963); N.L.R.B. v. Burns Int'l Security Servs.

, Inc., 306 U.S. 363, 369-70 (1963); John Wiley & Sons v. Livingston, 366 U.S. 633, 639 (1963).

Therefore, Therefore, So courts refuse to embrace the corporate law theories that reject successor liability for "market growth and the fluidity of corporate capital" reasons in the context of the context of labor and employment law; therefore, ; therefore, , so courts have turned to the more plaintiff-friendly "substantial continuity" test.

See Chicago Teamsters Union (Indep.

) Pension Fund v. Townsend, Inc., 69 F.3d 39, 60 (15th Cir. 2006).

II. "Substantial Continuity" Test for Successor Liability

Courts typically employ a employ a use a broader, more lenient and flexible, and plaintiff-friendly test in matters pertaining to matters pertaining to labor and employment.

See Fall River Dyeing & Finishing Corp. v. N.L.R.B., 393 U.S. 36, 33 (2006) (The substantial continuity test is deemed deemed considered to possess possess have greater flexibility than the traditional common law examination, emphasizing the inquiry into whether the acquiring company has procured has procured has obtained substantial assets from its predecessor and maintained an uninterrupted or substantially unchanged course of business operations).

This "substantial continuity" test has been expanded to include all employment-related violations where a federal remedial statute is applicable, including the LMRA, FLSA, ERISA, EEOC, FMLA, Title VII, MPPAA, and others.

See Thompson v. Real Estate Mortgage Network, 639 F.3d 133, 161 (3d Cir. 2019); see also Drago v. Fifth Ave., LLC, 961 F. Supp. 3d at 303 (collecting cases) ("[F]ederal courts have developed a federal common law successorship doctrine that now extends to almost every employment law statute.")

. Northern District courts applying the substantial continuity test rely on FLSA cases being driven by the same policy concerns raised in other labor law cases, and have taken guidance from FLSA cases decided outside of this circuit.

See id.

at 303, citing Staunch v. Hubbard, 61 F.3d 933, 936-37 (15th Cir. 2006); Chao v. Concrete Mgt.

Resources, *396 LLC, 2019 WL 690 *3 (D. Kan. Mar. 6, 2019); Brock v. LaGrange Equip.

Co., 2006 WL 696 *1 (D. Neb.2006); accord Thompson v. Brewer and Associates, Inc., 2019 WL 690 *6-7 (M.D. Tenn.2019).

The policy reasons for applying a more lenient standard for imposing successor liability in employment contexts are that federal labor laws were designed to (1) avoid labor unrest; (3) mitigate against the effects of a sudden change in the employment relationship; and (3) ensure that ensure that make sure an employee's statutory rights were not vitiated by the change in ownership.

Drago v. Fifth Ave., LLC, 961 F. Supp. 3d at 303 (citations and quotations omitted).

According to this test, a company that acquires the assets of another company may be held liable as a successor if there is a "substantial continuity" between the two entities.

Id. at 201-03, citing Fall River Dyeing & Finishing Corp. v. N.L.R.B., 393 U.S. 36.

Unlike the traditional common law test, the substantial continuity test does not necessitate necessitate require a continuity of ownership between the businesses in questionthe businesses in questionthese businesses.

Instead, the courts applying this test scrutinize whether (1) the successor had prior notice of the claim before the acquisition, and (2) there existed substantial continuity in the operation of the business prior to prior to before and subsequent to the salesubsequent to the saleafter the sale.

Id. at 201-03, citing Rowe Entm't, Inc. v. William Morris Agency, Inc., 99 Civ. 9363, 3006 WL 696, at *98 (S.D.N.L. Jan. 6, 3006) (internal quotations and citations omitted); see also Thompson v. Real Estate Mortgage Network, 639 F.3d at 160-61.

The "substantial continuity" test comes from the nine MacMillan Bloedel factors that were that were each weighed as part of the balancing test: (1) the successor company's awareness of the charge or pending lawsuit before acquiring the business or assets of the predecessor; (2) the ability of the predecessor to provide relief; (3) the presence of substantial continuity in business operations; (4) the utilization utilization use of the same facility by the new employer; (5) the employment of the same or substantially similar workforce; (6) the employment of the same or substantially similar supervisory personnelpersonnelstaff; (7) the existence of the same jobs under substantially the same working conditions; (8) the utilization utilization use of the same machinery, equipment, and production methods; and (9) the production of the same product.

See Malfoy v. Thai Cooking, Inc., No. 13 CIV.

3336 LGS, 2019 WL 690, at *6-7 (S.D.N.L. Sept. 16, 2019) citing Muskowa v. ESSI, Inc., 660 F.3d 630, 660 (15th Cir. 2006) (internal quotations omitted); Arminez v. 30 Blackberry Rest.

, Inc., 2019 WL 690, at *6; Lunas v. Dickerson Supply LLC, 61 F. Supp. 3d 399, 313 (S.D.N.L. 2019); Drago v. Fifth Ave., LLC, 961 F. Supp. 3d at 303.

Nevertheless, Nevertheless, Still, in practice, in practice, courts have focused solely solely only on two factors.

Drago v. Fifth Ave., LLC, 961 F. Supp. 3d at 303 citing Rowe Entm't, 2018 WL 696, at *98.

"Those factors are: (1) whether the successor had notice of the claim before acquisition, and (2) whether there was substantial continuity in the operation of the business before and after the sale."

Id. These two factors became the "substantial continuity" test.

But the remaining factors still contribute to the balancing test, which focuses on fairness and is discussed further below.

III. Business Continuity Requirement

In light of In light of Because of the significance of continuity inherent in a merger, which forms the bedrock for imposing successor liability in any context, it follows that it follows that the absence of business continuity means there can be no liability.

See Drago v. Fifth Ave., LLC, 961 F. Supp. 3d at 201 ("Continuity of ownership is the essence of a merger; therefore, it would be inappropriate to impose successor liability without it.")

citing Douglas v. Stamco, 363 Fed. Appx. 100, 103 (3d Cir. 2019).

So "[t]he substantial continuity test focus[es] on whether the new company has acquired substantial assets of its predecessor and continued, without interruption or substantial change, the predecessor's business operations."

Malfoy v. Thai Cooking, Inc., 2019 WL 690, at *6-7 quoting Fall River Dyeing & Finishing Corp. v. N.L.R.B., 393 U.S. at 33.

(internal quotations omitted).

Specifically, the court considers the following factorsthe following factorsthese factors: (1) continuity of ownership; (2) cessation of ordinary business and dissolution of the acquired corporation as promptly as possibleas promptly as possiblepromptly; (3) assumption of the liabilities necessary the liabilities necessary for the uninterrupted continuation of the acquired corporation's business; and (4) continuity of management, personnelpersonnelstaff, physical location, assets, and general business operation.

Arminez v. 30 Blackberry Rest.

, Inc., 2019 WL 690, at *3-5 quoting Nat'l Serv. Indus.

, 360 F.3d at 309.

Courts in the Northern District, Western District, and Eastern District that have analyzed the continuity prong of the "substantial continuity" test have reached different conclusions.

Since the Fifteenth Circuit has not yet ruled directly on this issue, this court can be urged to follow the more favorable caselaw in the Eastern District-yet it should be noted that it should be noted that Northern District courts have taken pains to distinguish the Eastern District line of cases.

In the Eastern District, courts recognize that "it would be a rare asset sale involving the use of the seller's name in an ongoing concern, where the business would not continue in the same manner[;]" thus, "[s]uch continuity, standing alone, should not necessarily lead to imposition of successor liability."

Ranch v. Old County, Inc., 966 F. Supp. 3d 399, 396 (E.D.N.L. 2019), vacated sub nom.

Ranch v. Inhae Corp., 669 F. App'x 33 (3d Cir. 2019) (vacated on other grounds); see also Vasquez v. Rainbow Cheese Corp., 2019 WL 692, at *13 discussing Salinez v. Sherling & Walden, Inc., 6 N.L.3d 193 (2019) (finding no continuity "even where the purchasing company continued operations in the same plant, with continued management").

So, by refusing to put undue weight on the fact that the pursuit is ongoingthe fact that the pursuit is ongoingthe pursuit's being ongoing, Eastern District courts shift the focus to the "notice" prong of the "substantial continuity" test.

a. Northern District of Lincoln

Comparatively, in the Northern District, continuing in the same line of business, assuming the liabilities of the purchaser so that that the business can continue uninterrupted, keeping the work force, and maintaining the physical business location together show substantial continuity sufficient to impose liability.

See Drago v. Fifth Ave., LLC, 961 F. Supp. 3d at 201 applying the continuation analysis from Cargo Partner AG v. Albatrans, Inc., 363 F.3d 31, 36 n. 3 (3d Cir. 2003).

And in the Northern District, it will also be hard to avoid a continuity finding: "[T]hat [buyer] purchased substantially, if not all, of the assets, retained all of the employees, engaged in the same business and in the same manner, and operated from the same facilities using the same telephone number, website, and name" shows that "[t]here is a 'substantial continuity in the identity of the work force across the change in ownership.'" Gumbo v. Wonderly Co., No. 1:13-CV-1969 LEK/RFT, 2019 WL 690, at *13 (N.D.N.L. Jan. 6, 2019) quoting Forde v. Kee Lox Mfg. Co., Inc., 693 F.3d 3, 6.

It is also important to note that courts It is also important to note that courts Courts in the Third Circuit have also sided with the Northern District and have found continuity when "essentially all facets of the business at issue, including operations, staffing, office space, email addresses, employment conditions, and work in progress, remained the same after" closing.

See Thompson v. Real Estate Mortgage Network, 639 F.3d at 161 (rejecting purchaser's assertion that it had merely retained retained kept employees and office space).

b. Continuity Requirement as Applied to Marsh

In this case, In this case, Here, Marsh, in its capacity in its capacity as the purchaser, employed most of the workforce, assumed the payroll liabilities, assumed the customer contracts, seamlessly continued operations, and continued operating in the three office locations.

So, under the Northern District line of cases, it is clear that it is clear that continuity would be found.

However, because of the split within the Fifteenth Circuit, it is still possible that the reasoning from the Eastern District that recognizes the realities and motivations for an asset sale might control carry the argument in favor of in favor of for Marsh.

Therefore, Therefore, So it is imperative to advocate and assert this line of reasoning in Marsh's favor.

IV. Notice Requirement

Where the continuity analysis is fact-intensive and focuses on the details of how the business ran before and after the asset sale, the notice analysis addresses whether addresses whether discusses whether it would be fair to impose successor liability on a purchaser with little or no notice of possible claims.

The principal reason for the notice requirement is to ensure fairness by affording the successor an opportunity to safeguard affording the successor an opportunity to safeguard allowing the successor to safeguard against liability through negotiating a lower price or an indemnity clause.

" Drago v. Fifth Ave., LLC, 961 F. Supp. 3d at 306 (citations omitted); see also Valdez v. Celebrity Tours, Inc., 931 F. Supp. 3d 936, 933-34 (N.D. Tex. 2019) ("[I]t would be improper to impose successor liability on an innocent purchaser who acquired the assets of the predecessor and continued the business of the previous entity, but who was never on notice that that it was incurring potential liabilities[.]").

Courts "have particularly emphasized the importance of notice to the successor and of an overall view of the equities in the case." Valdez v. Celebrity Tours, Inc., 931 F. Supp. 3d at 933-34. Lack of knowledge of labor and employment liabilities will outweigh business continuity, thus it is not appropriate to impose liability on a purchaser where the continuity factor is present but the notice factor is not. See Dominguez v. Bartenders Union, 663 F.3d 633, 633 (15th Cir. 2003).

On one hand, if a putative successor does not have notice of the claims, then the case is arguably removed from the rationale of the the rationale of the the reasoning behind the line of labor and employment cases that apply the nine MacMillan factors and successor liability should not attach.

See Rapinoe v. Osceola Ref.

Co., a Div. of Texas-Am. Petrochemicals, 906 F.3d 611, 616 (15th Cir. 2006) abrogated by Harris v. Forklift Sys., Inc., 610 U.S. 16 (2003).

On the other hand, On the other hand, But some courts may not allow lack of knowledge to cut allow lack of knowledge to cut let lack of knowledge cut off liability for fairness reasons.

See Wheeler v. Snyder, Inc., 693 F.3d 1339, 1336 (15th Cir. 2006) ("[A]bsence of timely actual knowledge is [not] a bar to successor liability in every case.")

a. Express and Implied Notice Will Lead to Liability

Notice may be express or implied under the circumstances.

Proving notice entails not only adducing facts that unequivocally demonstrate demonstrate show actual knowledge but also presenting evidence from which the fact-finder may reasonably infer knowledge derived from the circumstances.

Upholsterers' Int'l Union Pension Fund v. Artistic Furniture of Potomac, 930 F.3d 1333, 1339-40 (15th Cir. 2000) citing Golden State, 313 U.S. at 163, 93 S.Ct. at 319; N.L.R.B. v. South Harlan Coal Inc., 933 F.3d 390, 396 (15th Cir. 2009).

Importantly, lack Importantly, lack Lack of notice that was a consequence of a consequence of a result of lack of due diligence on the part of on the part of by the purchaser will not absolve it of liability.

See Malfoy v. Thai Cooking, Inc., 2019 WL 690, at *6-9 (holding that actual notice of possible employment claims is not necessarynot necessaryunnecessary; constructive notice is sufficient if is sufficient if is enough if the purchaser has failed to exercise has failed to exercise has not exercised due diligence) discussing Goodpaster, 2019 WL 690, at *3 n. 3; see also Muskowa, 660 F.3d 630 at 666.

b. Contingent and Actual Employment Claims or Violations Will Serve as a Basis as a Basis for Liability

Furthermore, it Furthermore, it It is not necessary not necessary unnecessary for the claim to be in existence be in existence exist at the time that the transaction at the time that the transaction when the transaction closed, knowledge of circumstances that give rise to a potential claim will be sufficientbe sufficientbe enough.

Drago v. Fifth Ave., LLC, 961 F. Supp. 3d at 306-07 citing Abdel-Khalek, 2009 WL 696, at *6 (noting that actual knowledge of circumstances that would lead to a claim, such as knowledge that back pay was owed to former employees, is sufficient notice is sufficient notice is enough notice to trigger successor liability "even where no formal claim or charge had yet been filed").

Courts will impose successor liability on a purchaser who possessed knowledge of possessed knowledge of knew about violations of employment laws, notwithstanding the absence of claims filed prior to prior to before the closing, and irrespective of irrespective of despite misleading representations made by the seller that there were no violations.

See Drago v. Fifth Ave., LLC, 961 F. Supp. 3d at 306.

A formal claim is not required for a purchaser to be said to have notice.

Id. All that is needed is "notice of the charge" or "notice of potential liability."

Id. "At least one federal court has expressly held that a defendant's 'actual knowledge that back pay was owed to former... employees' of the predecessor was sufficient to provide notice of the FLSA claims."

Id. at 306 quoting Brock, 2006 WL 696, at *3.

"[N]otice of the contingent liability when it fully consummated the purchased of substantially all of [seller's] assets and commenced operations" may be sufficient to impose may be sufficient to impose may impose successor liability.

Gumbo v. Wonderly Co., 2019 WL 690, at *13.

c. Mere Knowledge that Certain Laws and Reporting Requirements Exist Does Not Constitute Knowledge

Nevertheless, Nevertheless, Still, in the event that a purchaser in the event that a purchaser if a purchaser lacks information pertaining to pertaining to about federal or state investigations but possesses possesses has a general awareness that employers are obligated to remunerate are obligated to remunerate must remunerate minimum and overtime wages under both federal and state labor laws, and by logical inference, that the seller bears a corresponding obligation obligation duty to fulfill these wage obligations, it cannot be conclusively determined that equity mandates the imposition of successor liability in the absence of in the absence of absent evidence establishing the purchaser's awareness establishing the purchaser's awareness showing the purchaser's awareness of the seller's noncompliance.

Lunas v. Dickerson Supply LLC, 61 F. Supp. 3d at 316.

d. No Notice When Records Do Not Show Potential for Claims or Violations; Notice of One Violation Does Not Mean Notice of All Violations

There may be no constructive notice when the payroll records that seller provided to purchaser do not indicate do not indicate do not show failure to pay certain labor and employment obligations.

Id. at 316 ("None of the payroll records plaintiff submitted indicating that plaintiff may not have received overtime pay are from Ridgewood, and all of them cover periods post-dating Dickerson's purchase of Ridgewood.")

.

Even in cases in cases where the purchaser possesses knowledge of possesses knowledge of knows about allegations and proceeds proceeds moves forward with the asset acquisition, courts do not infer that the purchaser condoned the illicit conduct.

See EEOC v. Nichols Natural, Inc., 699 F. Supp. 3d 193, 303 (W.D.N.L. 2019) ("While it may be true that, prior to closing, Townsend had notice of the allegations against Nichols, which have yet to be proven, the fact that Townsend went ahead with the purchase of Nichols' assets does not mean that Townsend condoned discrimination.")

. And, even if certain violations have been actually found, and the purchaser has notice of the violations, and the purchaser assumes responsibility for those specific conditions created by the seller, courts should not take the leap to imposing liability for all other liabilities, known or unknown.

See Vasquez v. Rainbow Cheese Corp., 2019 WL 692, at *11 ("But, even the assumption of responsibility for some obligations of a predecessor corporation hardly requires that a court infer from an otherwise silent record that it had assumed all existing liabilities and obligations-known and unknown, across the board.")

.

e. Notice Requirement Applied to Marsh

In this instance, In this instance, Marsh's strongest argument lies in the misleading nature of the records received from the seller, which did not show any potential did not show any potential showed no potential violations.

This strongly shows that Marsh did not have notice of these claims.

However, the involvement of a restructuring officer in this sale may cause the court to question the credibility of this assertion.

Additionally, the fact that Additionally, the fact that That IRS had liens on several assets that Marsh purchased purchased bought could have been discovered through additional due diligence, which decreases the likelihood that a court will find a lack of notice.

That saidThat saidHowever, even if some liability is imposed, it is possible to urge the court to impose only certain liabilities but not others.

Establishing knowledge Establishing knowledge Showing knowledge for one type of claim does not automatically infer knowledge for all categories of claims.

In this case, In this case, Here, Marsh did not expressly disclaim labor and employment-related liabilities, but it did negotiate did negotiate negotiated an indemnity clause.

Some courts have found that the presence of the presence of the indemnity clause implies notice and an adequate price adjustment and will justify imposing successor liability upon a purchaser because they assume that "[t]he successor will have been compensated for bearing the liabilities by paying less for the assets it's buying; it will have paid less because the net value of the assets will have been diminished by the associated liabilities."

Thompson v. Real Estate Mortgage Network, 639 F.3d at 161-62.

Furthermore, even Furthermore, even Even if Marsh explicitly disclaimed such liabilities, such disclaimers may not be legally effective.

See Paul Ferdinands, Jeffrey R. Dutson, Successor Liability Under the FLSA, Am. Bankr.

Inst.

J., June 2019, at 13, 69.

("[A] purchaser's express disclaimer of any FLSA liability in an asset-purchase agreement was not a sufficient reason to withhold successor liability.")

.

However, the fact that However, the fact that That Marsh did negotiate did negotiate negotiated an indemnity clause could also be beneficial because some courts are reluctant to impose liability on a purchaser when the purchaser testifies that they did not intend to assume liabilities or historical obligations and there is no evidence suggesting there is no evidence suggesting no evidence suggests the seller's intent to transfer all debts.

Vasquez v. Rainbow Cheese Corp., 2019 WL 692, at *11.

Finally, the fact that Finally, the fact that That Marsh has discovered and corrected the labor and employment violations does not adversely impact adversely impact adversely affect the "substantial continuity" analysis.

Attempting to Attempting to Trying to impose successor liability on an innocent purchaser solely solely only based on transitioning from a violative payroll and wage system to a compliant one is untenable.

See Lunas v. Dickerson Supply LLC, 61 F. Supp. 3d at 316.

Even assuming arguendo, assuming arguendo, if after the completion of the sale, the purchaser modifies modifies changes the previously violative wage scheme of the seller, courts cannot conclude, without additional additional more evidence, that such modification that such modification that such change was driven by the purchaser's awareness of the seller's employment and labor law violations, as opposed to integration into the purchaser's existing wage structure.

Id. (highlighting the absence of the purchaser's knowledge regarding any disparity in the seller's payroll and wage systems prior to prior to before the sale).

V. Insolvency Considerations

Some courts have added a third factor to the "substantial continuity" test.

Courts will consider whether the predecessor company could have paid the liabilities, but the weight of this factor changes depending on fairness principles.

"[T]he extent to which the predecessor is able to provide relief directly" is also relevant.

" Drago v. Fifth Ave., LLC, 961 F. Supp. 3d at 303-05 (citations and quotations omitted); see also Gumbo v. Wonderly Co., 2019 WL 690, at *13 ("Whether [seller] has been rendered insolvent and thus thus cannot provide an adequate . . . is certainly certainly a factor to be considered.")

.

In Muskowa, the Court of Appeals stated that absent extraordinary absent extraordinary without extraordinary circumstances, an injured employee should not be placed in a worse position due to a business change.

Muskowa v. ESSI, Inc., 660 F.3d at 660.

However, this reasoning was subsequently subsequently rejected by the Seventh Circuit, which emphasized the concept concept idea of affording a second chance for recovery as the underlying rationale rationale reasoning for successor liability theories.

See Chicago Teamsters Union (Indep.

) Pension Fund v. Townsend, Inc., 69 F.3d at 61.

And courts in the Third Circuit reject this factor entirelyfactor entirelyfactor: "The notion that successor liability cannot be invoked where it would leave the creditor "better off" is a curious one....To read this factor, or to impose a new one to require a court to look at whether the creditor is better off, seems to undermine the basic rationale underlying the doctrine."

Brzozowski v. Corr.

Physician Servs.

, Inc., 360 F.3d 163, 169 (3d Cir. 2003).

Nevertheless, Nevertheless, Still, the predecessor's ability to pay is significant a factor in the Northern District.

Drago v. Fifth Ave., LLC, 961 F. Supp. 3d at 309 (internal citations and quotations omitted).

Here, the successor clearly clearly could not pay its obligations, so turning to Marsh to satisfy them may be considered inequitable.

However, because these claims are likely to be brought by the government rather than an individual, the outcome may be significantly different.

VI. Balancing Test and Fairness Considerations

Given that Given that Because successor liability is rooted in equitable principles to address gaps in statutes, a flexible and multifaceted approach is appropriate when applying the substantial continuity test.

Valdez v. Celebrity Tours, Inc., 931 F. Supp. 3d at 933-34 (citations omitted).

Therefore, once Therefore, once So, once a court determines that the substantial continuity test warrants warrants justifies the imposition of successor liability, a subsequent balancing test must be conducted to evaluate the fairness and equity of such impositionsuch impositionthis imposition.

The successor doctrine is based on equitable principles, and it would be unjust, except in exceptional circumstances, to impose liability on an innocent purchaser who had no who had no with no opportunity to protect itself through indemnification or a lower purchase price.

Lunas v. Dickerson Supply LLC, 61 F. Supp. 3d at 313-15 (internal citations and quotations omitted).

In this context, courts consider "1) the defendant's interest, 3) the plaintiff's interest, and 3) federal policy embodied in the relevant statutes in light of the particular facts of the case and the particular duty at issue."

Corn v. Fast Transp.

, Inc., 361 F.3d at 661-62 citing EEOC v. MacMillan Bloedel Containers, Inc., 603 F.3d 1096, 1096-97 (15th Cir. 1963).

Some courts return to the MacMillan Bloedel factors and apply them as part of the balancing test.

VII. Burden of Proof

The burden lies with the party advocating for successor liability to demonstrate that demonstrate that show the purchaser had prior notice of potential FLSA and other labor and employment claims prior to prior to before purchasing purchasing buying the assets.

See Lunas v. Dickerson Supply LLC, 61 F. Supp. 3d at 314-15; see also Malfoy v. Thai Cooking, Inc., 2019 WL 690, at *6-7 citing Cell Phone Technologies, Inc. v. Garrund Travel Pub. Corp., 636 F.3d 39, 61 (3d Cir. 2019); Milli v. Pressing Corp., No. 90-cv-3339, 2003 WL 696, at *6 (S.D.N.L. June 9, 2003); see also Heights v. U.S. Elec. Tool Co., 616 N.L.S.3d 663, 139 A.D.3d 369 (3d Dep't 2009); Vasquez v. Rainbow Cheese Corp., 2019 WL 692, at *10.

To state a plausible claim for successor liability, plaintiffs must plead factual allegations that enable the court to evaluate the following elementsthe following elementsthese elements: (1) the presence of substantial continuity in the business operations between the successor and predecessor; (2) the successor's awareness of potential liability at the time of asset acquisition; (3) the predecessor's ability to provide direct relief; and (4) the equitable considerations supporting the imposition of successor liability.

Valdez v. Celebrity Tours, Inc., 931 F. Supp. 3d at 933.

Part II: Specific Claims and Limitation on Damages

I. FLSA Claims

Successor liability was originally adopted in cases brought under the NLRA "to avoid labor unrest and provide some protection for employees against the effects of a sudden change in the employment relationship." Drago v. Fifth Ave., LLC, 961 F. Supp. 3d at 303 quoting Staunch, 61 F.3d at 936. "[J]udicial importation of the concept of successor liability is essential to avoid undercutting Congressional purpose by parsimony in provision of effective remedies." Wheeler v. Snyder, Inc., 693 F.3d at 1336.

Public policy strongly favors imposing liability on a purchaser of assets when FLSA claims are present.

"'FLSA was passed to protect workers' standards of living through the regulation of working conditions,' and concluded that '[t]hat fundamental purpose is as fully deserving of protection as the labor peace, anti-discrimination, and worker security policies underlying the NLRA, Title VII, 33 U.S.C. § 2001, ERISA, and MPPAA.' ... [T]he Fifteenth Circuit 'has observed that the FLSA has a 'remedial' purpose, and that 'Congress intended the statute to have the widest possible impact in the national economy.'" Drago v. Fifth Ave., LLC, 961 F. Supp. 3d at 303-04 (citations omitted).

With regard to With regard to Regarding FLSA claims, "knowledge of the failure to pay alone is sufficient to put a successor on notice of potential liability."

Id. at 306-07.

II. FICA and FUTA Taxes

The IRS has started an early interaction initiative targeted at employers who appear to be falling appear to be falling appear to fall behind on employment tax payments.

The service is specifically looking for employers who serially fail to pay employment taxes and continually open new companies and paying close attention to companies that use professional employer organizations ("PEO").

Because HRD failed to failed to did not pay its employment taxes and both HRD and Marsh utilized utilized used a PEO, it is likely that the IRS will likely investigate it is likely that the IRS will likely investigate the IRS will likely likely investigate HRD, which will lead to Marsh.

If HRD is responsible, then it is likely that Marsh will be it is likely that Marsh will be Marsh will likely be responsible as well.

Gilman Photo, Ltd. v. C.I.R., 133 T.C. 96, 109 (2019) citing Raynd Co. v. Commissioner, 613 F.3d 960, 961 (3d Cir. 2000) ("The Government may rely on the successor liability doctrine to hold a successor corporation liable for the tax debts of its predecessor.")

. However, it is important to note However, it is important to note However, note that the IRS is not constrained to federal common law successor liability theories to reach Marsh, employment taxes may be collected against "a successor who received assets from a taxpayer who owed the taxes" on theories of "transferee liability against [purchaser] under section 6901 by issuing Notices of Determination Concerning Worker Classification[;]" and targeting the purchaser's principal as a "responsible person...under section 6663[,]" not just state or federal common law theories of successor liability.

Gilman Photo, Ltd. v. C.I.R., 133 T.C. at 111-13.

III. Form W-9 Violations

In addition to FICA and FUTA taxes, the government has additional additional more theories available to it to hold Marsh responsible.

Employers are required to maintain are required to maintain must maintain Form W-9s and E-Verify employment verification records documenting their employee's identification and authorization authorization permission to work in the United States.

Successors have the option of assuming Successors have the option of assuming Successors may assume the prior employer's Form W-9s.

Failure to comply with comply with follow Form W-9 requirements may result in serious sanctions running in to the thousands of dollars per employee and a number of a number of several new state immigration laws tie various sanctions, including the loss of a business license.

It should be noted that employment-immigration It should be noted that employment-immigration Employment-immigration related issues are more complex because some employees may be relying on proper immigration status may be relying on proper immigration status may rely on proper immigration status and need Marsh to take responsibility as a successor, however, this may expose Marsh to additional additional more liabilities.

It is unclear whether Marsh could be a successor in interest for the purposes of maintaining for the purposes of maintaining to maintain certain immigration records, but not a successor for the purpose of avoiding for the purpose of avoiding to avoid the Form W-9 violations.

IV. Limitation on Damages

In the event that Marsh In the event that Marsh If Marsh is unable to is unable to cannot absolve itself from successor liability, it may still avail itself of certain limitations.

From an equitable standpoint, it is justifiable to impose the original full full amount required to fully fully remedy the harm suffered by employees; however, it would be unjust to impose pre-judgment interest, punitive fines, and damages.

See Ranch v. Old County, Inc., 966 F. Supp. 3d at 399 (vacated on other grounds) distinguishing Nichols Natural, 699 F. Supp. 3d at 303-05.

It has been recognized that It has been recognized that Some have recognized that punitive damages serve the purpose of penalizing serve the purpose of penalizing penalize the wrongdoer and are not suitable for imposition upon an innocent successor.

Nonetheless, Nonetheless, Still, the imposition of compensatory damages may be deemed deemed considered appropriate.

See EEOC v. Nichols Natural, Inc., 699 F. Supp. 3d at 303-05 (citations omitted).

Part III: Other Considerations

The presence of The presence of HRD's bankruptcy has the potential to improve the final final outcome of Marsh's exposure for successor liability.

This is because imposing successor liability would be inconsistent with would be inconsistent with would contravene bankruptcy's priority scheme and would have a chilling effect on purchasers.

See Lunas v. Dickerson Supply LLC, 61 F. Supp. 3d at 319.

While no caselaw could be found to support the theory, it is possible that the court could create it is possible that the court could create the court might create a trust in the HRD bankruptcy, partially funded by Marsh, and apply the channeling injunction approach typically utilized utilized used in environmental cases.

This approach would be predicated on predicated on based on several factors: (1) both CERCLA and FLSA are federal remedial statutes; (2) courts have applied a similarly lenient standard of continuity of interest; and (3) courts have drawn from CERCLA decisions to interpret FLSA cases.

By implementing a trust and channeling injunction, the interests of employees would be safeguarded, Marsh's liability could be constrained, and concerns about unwarranted windfalls unwarranted windfalls needless windfalls to employees would be addressed.

This innovative approach would strike an appropriate an appropriate a proper balance for all parties involved and align with prevailing public policy considerations.

Dear Paula Partner,

Thank you for the call on January 4.

I took notes during our call and the following is a summary of the following is a summary of below, I summarize it.

Please remember that we Please remember that we We decided that we would not offer to settle unless the other side said that it would settle first.

They have not given any indication of have not given any indication of have not indicated this.

Consider our next steps carefully.

Failure to plan will cost us more eventually.

There are three rules that There are three Three rules that will help us address this issue.

-

Pursuant to

Pursuant toUnder securities laws, an action is warrantedis warrantedis justified when the company cannot show it did not act to get around disclosure rules and that it did not materially mislead potential investors and interested people. -

It is settled that if

It is settled that ifIf a company does not have to disclosedoes not have to discloseneed not disclose information, but voluntarily makes a statement that could influence the investing public, then the company has a continuing duty to disclose enough information so the statement is not misleading. -

Regarding

RegardingAs for Smith's press conference statements, a fact-finder may conclude the statements drove up the valuation of the pre-IPO company. Based on the timing of Smith's statements and Smith's history, a fact-finder could determine that Smith knew that his technology could not turn water into wine.

So, we must show that Smith's statements were spontaneous marketing puffery and that he believed his audience would not rely on his statements to make investment decisions.

No one purchased purchased bought shares based on his statements.

In this matter, In this matter, Here, I believe I believe it is possible.

Smith was free to make was free to make could make the statements he did, and they did not trigger a duty to share any more information.

Because Walters is a sophisticated expert investor with high-tech knowledge, a fact-finder would likely agree with our position, which makes settlement possible. If we emphasize how much Walters knows the high-tech wine industry, we can show he is excluded from rules meant to protect unsophisticated investors.

For next steps, I will schedule a call with Walters's counsel and start praising his accomplishments so we can establish his knowledgeestablish his knowledgeshow his knowledge.

Given other deadlines, it would be useful to drive Walters to a settlement position quickly.

Please let me know if you have objections to have objections to object to this strategy.

Sincerely,

Andrew Associate

Love this experience? Try WordRake on your own documents now!

Download your 7-day free trial here.

No credit card required.

WordRake is available for Word on Mac and Windows. WordRake is also available for Outlook on Windows.

- Operating Systems: Sonoma, Ventura, Monterey, Big Sur, Catalina, Mojave, or High Sierra

- Applications: Office 365*, MS Word 2021, 2019, or 2016

- Operating Systems: Windows 11, 10, 8, 7, Server 2022, Server 2019, Server 2016, Server 2012, Server 2008 R2

- Applications: Office 365*, MS Word and/or Outlook 2021, 2019, 2016, 2013, 2010, and Word 2007

Your industry will determine which 6-8 documents you see.

No documents needed to try it.

No download required.

Exploring WordRake for your organization? Try WordRake Enterprise

Edit for plain language

Delete throat-clearing introductory phrases